The Capital Stack

Swiss Village NO Deal

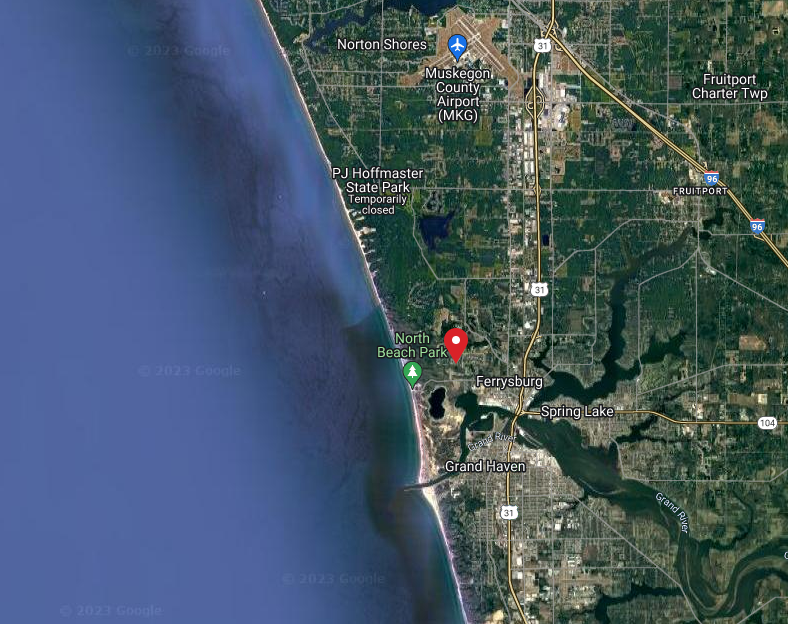

Swiss Village is a charming community comprised of 26 residential units spread across five beautifully designed buildings in the highly sought-after town of Spring Lake, Michigan. Situated on the stunning shores of Lake Michigan, Spring Lake is a picturesque town that offers residents and visitors an idyllic small-town experience with a range of amenities and attractions.

Nestled between the bustling coastal town of Grand Haven and the serene waters of Spring Lake, the town boasts a vibrant downtown area that features a variety of shops, restaurants, and local businesses. Not only does Spring Lake offer an abundance of local amenities and attractions, but it also meets our requirements for median income and home value, with a median income of approximately $62,000 and an average home value of around $368,000. These figures reflect a thriving community with a strong economy and a high standard of living, making it an ideal place to call home.

With its location on the Lake Michigan waterfront, Spring Lake offers a range of water-based activities, such as boating, fishing, and swimming. Visitors can also explore the nearby beaches or take a relaxing boat tour of the area.

How We Found It

We were introduced to the Swiss Village property through a broker with whom we have an established relationship.

The broker discovered the property listed on Zillow and quickly recognized its potential as a valuable addition to our investment portfolio. Understanding our investment criteria and priorities, he promptly forwarded the details and recommended that we conduct a thorough evaluation.

Why We Like It

The Swiss Village property is comprised of 26 units with a solid 96% occupancy rate and rent averaging $937.50 per occupied unit.

The property presented an already proven value add strategy as the owner had recently renovated a single unit and achieved a new rent of $1,250. This clearly demonstrated that the remaining 25 units could be upgraded to the same standard, potentially increasing the monthly income by $8,125 and adding approximately $1.4 million to the property’s overall value.

With such a crystal-clear financial picture, we saw that the Swiss Village property had the potential to be a home run from the very start. The combination of high occupancy rates, solid rental income, and a clear path to further value appreciation made this a compelling investment opportunity.

What We Offered

After carefully evaluating the Swiss Village property and its potential for value creation, we presented the seller with an offer of $2,200,000. This offer represented a 6.5% cap rate based on the property’s current income levels and taking into account the occupancy rate and average rent per unit.

Looking ahead, we projected that the property could stabilize at a 9.5% UYOC (Unlevered Yield On Cost). This alternative measure of cap rate considers all-in costs rather than just the purchase price.

SO, What Happened?

Despite our initial offer of $2,200,000, another buyer came in with a higher offer of $2,900,000. Their purchase price was supported with $300,000 of seller-financed debt, in addition to traditional bank debt at a rate of 70-80%. Such a highly leveraged deal did not make sense for us to compete with and is essentially paying the seller in advance for improvements that we would be completing ourselves. If we are the ones doing the work, we want to be sure our investors are the beneficiary rather than paying for it upfront.

We expressed our concerns to our broker and predicted that the deal would not close with those terms. We believed that the buyer offering $2,900,000 was an inexperienced buyer who was eager to close their first deal. About a month later, our predictions were proven right. The property was appraised at $2.2 million, which was the exact amount that we had offered. The buyer was unable to secure the debt and equity they had planned for, and the deal had fallen through.

This outcome reaffirmed our belief that it is important to avoid over-leveraging a property. We were glad to have stayed disciplined in our approach instead of attempting to compete with an offer that did not make sense.

When the property came back on the market, we delved deeper into the details and discovered that it was part of an apartment condominium development with around 20 buildings owned individually by different owners. Most buildings were 4-6 units. The 5 Swiss Village buildings owned by the seller were scattered throughout the community, which raised a red flag for us. All 20 buildings looked identical from the outside, and sharing lot boundaries with multiple owners created limitations on the improvements we could make to the community. Our largest concern was that other owners might no keep up on the renovations and capex needed, which could negatively impact our tenants’ rental prices and quality of life. We could do everything right to keep our building and tenant quality high, and the owner next-door could be renting his units for $500 to drug dealers (extreme to make a point) which would more than likely push our tenants away and restrict the rental prices that we could charge.

Long story short, we decided not to make another offer on Swiss Village as the potential issues outweighed the benefits. If the 26 units were on a separate lot, we would have been interested. In an ideal scenario, we could contact each owner in the development, purchase their properties, and transform the area back into a traditional apartment complex.

Major Market News

Adelaide Pointe Development

Just 20 minutes north of Spring Lake is the $250M Adelaide Pointe Development. According to a recent article by MLive the development celebrated its groundbreaking with a ceremony earlier this week. The article explains that the development will consist of 777 luxury apartments, a 233-slip marina, a luxury hotel, as well as retail and commercial space. It is being developed by a partnership between two companies, Grand Rapids-based Orion Real Estate Solutions, and Muskegon-based Core Realty Holdings Management Inc. The development is expected to create 500 construction jobs and 200 permanent jobs when it opens in 2025.

Link to Article here:https://www.mlive.com/news/muskegon/2023/05/250m-adelaide-pointe-development-on-muskegon-lake-celebrates-groundbreaking.html

Tips and Tricks

Tip- Don’t limit Improvements to the interiors

We aim to not only upgrade units but also improve the community by eliminating troublesome tenants and improving safety. Take the Pinehurst Apartments of Linden for example, when we purchased the property there were several “problem tenants”, including a homeless man that liked to sleep in the common areas and people partying in the laundry room. Both scenarios resulted in frequent calls to the police. These issues were caused by only a few tenants but were negatively impacting the entire community. Once we were able to remove the troubled tenets from the property it felt much safer for everyone.