The Capital Stack

Portfolio Property Update Part II

Our first quarterly update of 2023 continues..

Royal Oakland

Royal Oakland has reached “autopilot” status. Our current rent roll is $28,925. When we bought this property in August of 2020 the rent roll totaled $13,600. We achieved a 213% increase that took ~15 months to complete. We spent $500,000 on renovations completely changing the interiors of the property. It appraised at refinance in February of 22 for $4,150,000. Our all-in cost is $1,800,000. This continues to be one of our favorites.

Altitude

We bought this 52-unit property in October of 2021. We purchased Altitude with a 1031 exchange after we sold Ferndale 28. We were all into Ferndale 28 for ~$2.4m and we sold it for $3.7m exactly 366 days after we purchased it (this was intentional for capital gains tax purposes).

The rent roll when we bought Altitude was $42,180 and included 8 vacant units. Units were leased for an average rate of $958. Our current rent roll is $55,825 and includes 6 vacant units. As it sits, we have been able to increase the rent roll by 32%, once the remaining units are leased, we will be near a 50% increase when compared with the rent roll at purchase. We have owned this property for just over a year and have 11 units remaining to turn and bring rent to full or near full market rates.

Suburban 36

This 36-unit portfolio was purchased in July of 2022 for $4.85m. The portfolio consists of 16 ranch style units in Plymouth, MI called the Plymouth Gardens and 20 townhome units in South Lyon, MI called the Donovan Townhomes.

You can read the full write up that we wrote in June here:

https://sheffercapital.com/blog/plymouth-gardens/

https://sheffercapital.com/blog/donovan-townhomes/

Plymouth Gardens

The rent roll at closing was $17,790 and the property was 100% occupied. Since then, we have done cosmetic renovations to several units and signed renewals at increased rates. Our current rent roll totals $16,525 and includes three vacant units that are awaiting new leases. We are amid turning two of the three vacant units. We expect them to be rented by the end of the month. The properties 13 occupied units reflects a rent roll $16,525, our average rent per unit is $1,271.15. We have already achieved a 14% increase on leased units when compared with the rent roll at the time we purchased the property. We have had several tenants sign renewals at stay at the property. We still have 6 units remaining to bump to full market rates.

Donovan Townhomes

The rent roll at closing was $20,040 and the property was 100% occupied. The average rent at the property was $1,012. Since then, we have completed cosmetic renovations to several units and signed renewals at increased rates. Our current rent roll totals $23,155 with one unit vacant. The current average lease rate is $1,218.68 which is a 20% increase from where we started just 6 months ago. We’re very proud of how this project has been progressing and are excited to implement our business plan across the remaining 7 units.

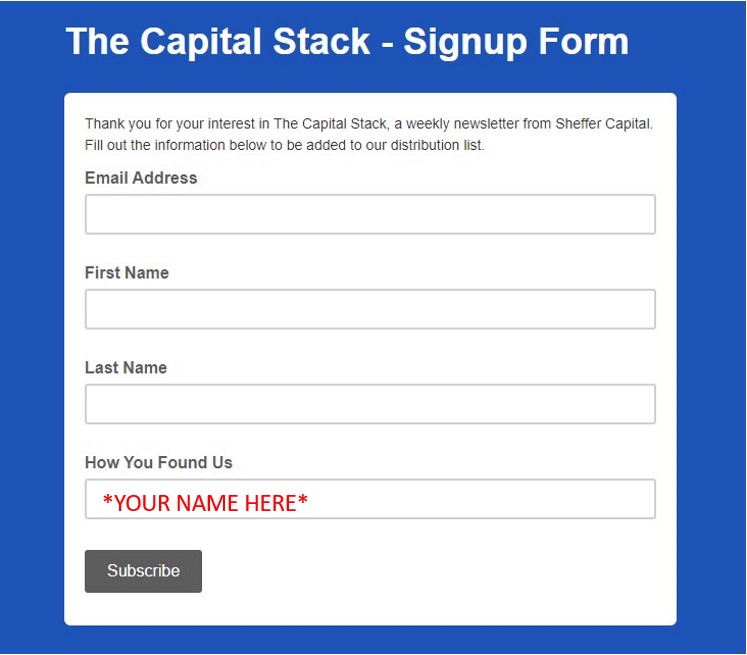

Newsletter Growth: Road to 5,000

Current Count: 2,189

+56 in the past week!

We are looking to grow our newsletter subscriber list. Currently we have 2,189 subscribers and the goal is 5,000. Since last week’s newsletter we have added 56 new subscribers. Let’s keep it going! If everyone gets 3 people to sign up, we beat the goal and will have something new to reach for. If you can get 3 people to sign up, I am happy to consult or answer any questions for 30 minutes on whatever you may be working on, or interested in. If you hate the idea of talking to me for 30 minutes but enjoy the newsletter, then just share it out of the kindness of your heart! Either way, the sharing is greatly appreciated!

*Have the new subscribers put your name or email in the “How You Found Us” section. *

Major Market News

Skyscrapers in 2023

According to the RealDeal’s Instagram post on Dec 22 of 2022 there are 5 mega skyscrapers yet to be completed in 2023. According to the post “Wuhan Greenland Center in China will be 1,560 ft”. Check out the post for more information on the other 4 features skyscrapers.

https://www.instagram.com/p/Cmo8Ln6JUBO/

Tips and Tricks

Tip:

Capital Gains Tax Timelines. Why did we sell in 366 days specifically?

Capital gains are taxed based on how long the asset is held. Anything under a year is considered “short term” and over a year is considered “long term”. Long term capital gains are taxes at 0%, 15%, or 20% depending on the individual income threshold of our investors. Short term capital gains are taxed from 10% to 37% as ordinary income depending on your tax bracket. If we had sold a day earlier we would subject our eventual tax burden to short term gains which could be taxed as high as 37%. This would result in an 85% higher actual tax liability. We went under contract around the 9 month period and intentionally required the buyer to close in October on our 366th day of ownership.

The gain on this was $1.3m so as a long term gain it would be taxed at $260,000, but as short term it would have incurred a tax liability of $481,000! This is also why we did a 1031 exchange, because now our full tax liability is pushed down the road and we won’t have to pay that until we sell Altitude. We will likely do another 1031 which again pushes the tax down the road again. This cycle never ends ideally.