The Capital Stack

Impending Doom

Intro

The latest hot button item in the news is the doom and gloom of the real estate market due to interest rates. Back in April, I wrote about interest rates and how we see them affecting the market. https://sheffercapital.com/blog/interest-rates-on-the-rise/

My thoughts at the time were that rates would need to go up ~2% to have a serious impact on the real estate market. This has now happened, and the effects are very real. I also noted how inflation in the 1970s led to primary home mortgages going from 7.64% up to 16.64% over a 10-year period. This is a 218% increase. In 2021 rates were in the low 3% to date rates are nearly ~7%. This is a 233% increase in just one year. Insanity.

Going back to April when we wrote the article, primary home rates were 4.72%, and 6.9% today. Residential home markets are slowing drastically as affordability gets crushed. I don’t claim to be some world-renowned economist and I think anyone with basic financial knowledge could understand how much of an impact this has on the average home buyer.

Personal Overall View

Here’s my overall view of what’s going on. The government printed too much money and borrowed money at unrealistic rates for 2 years because of Covid. As a result of this, inflation took off and the economy for us at least, boomed. In my opinion, this boom was completed fabricated. Now rates have skyrocketed, and the market is hitting the bust stage. Also in my opinion, it’s completely fabricated. With current markets “busting” I think the realistic option is that we return to the mean of 2019 where we had stable markets, stable economy, and stable rates (~4% avg). Going off the S&P Home Price Index (link below) the index increases an average of 4.4653 from July 1989 to July 2019. From July 19 to July 22, the increase was 95.702 which is a two-year average of 47.851. Obviously, this is a drastic outlier in the state of home values. Basic math in grade school will teach you to throw out the outliers as they aren’t relative to accurate predictions. Now for the index to return to the mean indicates a value of 209.55. This would be a 95-point reduction. This would be roughly double the drop that we saw from the peak in 2007 to the bottom in 2012. Huge drop in the short term but zoom out and we’re just going back to average in the residential market. Not so bad. Nobody was complaining about doom and gloom in 2019. Many have been predicting a real estate market crash since 2016 and Covid fed their ego to think they’re right. They were drastically wrong, and now insane rates are feeding those same egos where now is the time that they could be right. Yes, I think prices will likely go down in relation to 2021, but relative to 2019 and especially 2016, there’s no crash at all and I think we keep chugging along after this blip passes through. Zoomed out in 10 years it’ll be a short hiccup.

https://fred.stlouisfed.org/series/CSUSHPISA

What does this mean for Sheffer Capital Multifamily Portfolio?

Apartment values went up like crazy because borrowers were getting loans in the 3% range. Our lowest was 3.15%, 5 years, fixed rate. Uneducated Sellers who weren’t active in the market every day sold their properties for lower than market rate, and buyer were able to finance for incredible rates. We also sold at prices that didn’t make sense in our mind but found buyers happy to pay.

Here’s what these rates mean for our apartments. We planned to refinance one property in May of this year, that was cancelled because of rate hikes. The DSCR didn’t meet a hurdle where the refinance proceeds made sense to take. We have 5-year fixed + 5 years floating debt on this property at 4% so it would have been a bonus to get a refinance done before rates skyrocketed, but not needed to make the deal work. We are selling one property now and it will go for roughly 6% less than I think it would have sold for in the absolute peak. Our current average loan is 4.03% with the earliest maturity date being in 2026. For our current properties to be in real trouble, rent prices would have to crumble. In the last 70 years, rent has only gone down once, and it was -0.25% over a 5-year period. People need places to live and home ownership is even less affordable, so the rental market is still very strong. Many home buyers are staying put in their apartments until rates come down to where they can afford to buy for a similar monthly payment as their rent. Currently our apartments rent for ~$1,000+/month less than a mortgage for the median home in the area. The average home buyer can’t afford a $1,000 increase in housing just to own a home. Add on inflation across all other aspects of life (gas, groceries, etc), home ownership is becoming even further from possible for now.

Who will these rate hikes hurt the most?

Here’s who gets crushed by this. Many apartment buyers bought property in 2020-Q1 22 on 2–3-year total term debt. These properties will need to be sold or refinanced between now and the next 12-24 months to pay off those loans. Typically, lenders require a 1.25 DSCR (Debt Service Coverage Ratio).

Let’s put that in perspective with a hypothetical value-add property purchased for $7.5m that had a planned refinance at 4.5%.

Assume 75 units, $100k per unit purchase, $15k per unit renovations, all in for $8,625,000. Original loan at 80% LTC is $6,900,000 and $1,725,000 of equity. Lenders would have done this loan with projected end value of $9.2m bringing their loan to 75% LTV. Let’s assume value add brings the property value to $10m.

4.5% Refinance

Property value at 5% Cap Rate (after value add): $10,000,000

NOI: $500,000

DSCR: 1.25

Refi proceeds: $6,000,000

Prior loan is $6,900,000. There needs to be $900k brought to pay off this prior loan. These funds either come from current investors as a capital call, or from the sale of a property. New buyers have the same rates and 1.25 DSCR requirement. With $6m as the max loan amount, this new buyer will likely only want to pay $8,000,000 which gives them 75% LTV. This is already a loss to current owners of $625,000.

Now, where rates are today at mid 6 or higher, let’s use 6.5% for round math.

6.5% Refinance

Property value at 5% Cap Rate: $10,000,000

NOI: $500,000

DSCR: 1.25

Refi proceeds: $4,940,000

$1,960,000 is needed to pay off the original loan. This is almost 20% of the property value and more than double the original equity. Same scenario as above, new buyers have the same rates and DSCR requirements. With a max loan of $4,940,000 at 75% LTV, the new buyer will likely only want to pay $6,586,667. To sell at this price means the ownership needs to come up with an additional $313,333 just to pay off the original loan, and all investor equity is wiped out to $0.

Conclusion

In summary, I feel good about where we are at across our properties due to the lengthy loan terms and low rates we have secured. The ones who will be hit extremely hard are those who have loans coming due between now and the next 12 months. More than likely their best course of action is to approach their lenders as soon as possible and discuss extensions and overall loan modifications. Both the banks and borrowers want to avoid 2008 again so I’ve heard of many getting loan modifications to mitigate this disaster waiting to happen.

Major Market News

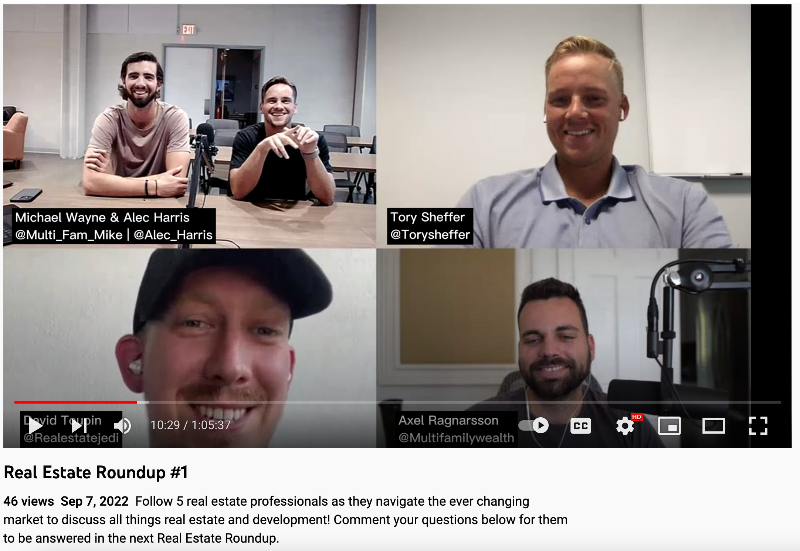

Real Estate Round Up

A couple friends and I have started a monthly podcast called Real Estate Round Up. In short, it’s an informal discussion between the 5-6 of us discussing what we have going on in our different areas of focus. The idea is to share for anyone curious as to what actually goes into the business rather than just the surface level stuff that is typically shared. This is episode 1 linked below, episode 2 coming soon. We’re also moving it to a more professional setup coming soon as well.

Here’s who’s on there and what their main focuses are.

- Michael Wayne – Class A Developer SE Michigan https://www.liveatjordan.com/home

- Alec Harris – Class A Developer SE Michigan

- David Toupin – Value add multifamily & storage, various sizes SE Michigan & Texas

- Axel Ragnarsson – Small multifamily in Northeast 2+ unit, Larger multi in FL, TX, IN 20+ units

- Zach Hoereth – Small single family & multifamily + storage, IN, TX

- Link here to the podcast on various sources:

- Youtube https://youtu.be/2EUofq0m0g8

- Apple Podcasts https://podcasts.apple.com/us/podcast/the-real-estate-roundup/id1644713171?i=1000579221519

Tips and Tricks

Terms

Capital Call – The GP on a real estate deal reaches out to existing investors stating they need more funds to cover costs. This could be for renovations, debt service, or any other expenses related to the property. Investors then need to decide if they want to contribute more capital to the deal or they can pass and their ownership gets diluted based on the new capital stack.