How Interest Rates Effect LP Investors

Mortgage interest rates are a hot button topic in the real estate industry. I recent months interest rates are on the rise as The Fed tries to fight this insane inflation (7%+). We obtained a bridge loan in 2020 at a 4% interest rate for our property Creekside at Fenton Heights. We recently shopped the same loan product for a property we are under contract on in Ferndale and the best rate the same credit union could do was a 5%. With mortgage interest rates on the rise it’s important to note how interest rate will affect our investor returns. The example below shows the loan terms and investor returns for a sample deal that would be typical of what we target.

Example #1

Loan amount: $3,035,200 (80% LTC – Purchase + renovations)

Rate: 4.25%

1 Year I/O

25 Year Amortization

LP Projected Return:

17.12% IRR

2.67x Equity Multiple

13.57% Cash on Cash

166.83% total ROI

$2,935,102 total proceeds

Example #2

Loan amount: $3,035,200 (80% LTC – Purchase + renovations)

Rate: 5.25%

1 Year I/O

25 Year Amortization

LP Projected Return:

16.09% IRR

2.61x equity multiple

12.46% cash on cash

161.35% total ROI

$2,874,804 total proceeds

In both examples the initial Investment is $1,100,000

Example 1: $1,100,000 x 2.67 = $2,935,103

Example 2: $1,100,000 x 2.61 = $2,874,804

-$60,299 or -2.05% total distribution difference, with the higher rate over the exact same business plan which is a value add and refinance in year 3, sell in year 10.

Both deals are solid. Obviously, example 1 has a higher return then example 2. In the grand scheme the monetary difference is not huge. Both interest rates shown in the example allow for a very worthwhile investment.

Our Take on Interest Rates

The interest rate for a given loan should be considered when underwriting any property. Using the exact loan terms available to you when underwriting a deal insures the pro forma is correct and the investor returns are as accurate as we can get. Interest rates and investor returns will fluctuate no matter what the model tells us. For there to be real material change we believe they would have to go up at least ~2%+ to make a large impact on investor distributions. I discussed interest rates on a recent podcast “Inside Real Estate”.

“If 0.25% or 0.5% on the debt rate kills the deal, the deal sucks in the first place”.

The podcast is linked below if you’d like to listen to the full episode. Interest rate discussion begins around 28:40.

What We Look For In A Loan

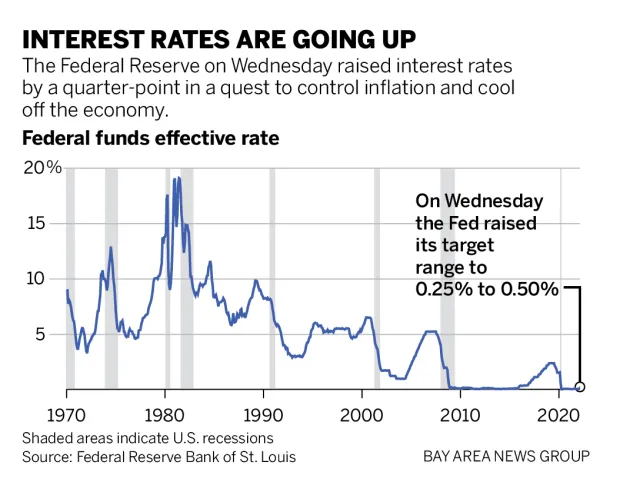

| Most of our deals are 5 year fixed mortgages. This allows us to lock in our interest rate for the next 5 years and not have to worry about the short term fluctuation. The one thing that does cause some reservation is that the last time the US had inflation at this level (1970s) primary home interest rates skyrocketed from 7.64% in 1971 to 16.64% in 1981. Anything similar to that rate increase would have major effects on every market. It will be interesting to see what happens in the coming years as inflation continues. |

Major Market News

| An Expert Opinion on Interest Rates There is a article published in February of 2022 by Globe St.com who quotes a real estate private equity manager saying “I see rates going up over the next 12 months”. According to the article the manager believes the trend upward will be at a moderate level. Check out the link for more information. https://www.globest.com/2022/02/11/finance-a-new-year-a-new-monetary-environment-for-cre/. |

| Tips and Tricks |

| Check out some popular real estate terms: LP Investors: Limited Partner. Investors are referred to as LP while the manager of the deal (Sheffer Capital) would be the GP or General Partner. Sheffer Capital typically participates as an LP investor as well as being the GP. Bridge Loan: Bridge loan is a loan with funds for the purchase of the property and funds for the renovations. Typical bridge loans are 2 year terms with a 1 year extension. These terrify me because of the short term rate risk so we have stuck with 5 year terms on all of our recent projects. |