The Capital Stack

Three Ways Real Estate is Tax Efficient:

Depreciation, Bonus Depreciation, 1031 Exchange

Depreciation

Depreciation is one of the lesser-known aspects of real estate investing but it can make a significant difference on the returns achieved. As buildings age they depreciate, tax code allows you to write off the depreciation each year as a loss. For an apartment building, the tax life is 27.5 years which means you can write off 1/27.5 of the building value each year.

Let’s say you buy an apartment building for $5,000,000. Tax code makes you account for land value of the property which is typically allocated as 15% of the purchase price. So, 85% of the purchase price is your “depreciable basis”.

$4,250,000 / 27.5 = $154,545 allowable annual straight line depreciation amount.

Now let’s say this $5m property was purchased at an 8% cap rate. The net income is $400,000 per year. Let’s use Michigan tax bracket for an example which is a 4% state tax and 35% federal. After depreciation, the taxable income from the property is now $245,455. In this case depreciation saves $60,273 in annual income taxes.

Bonus depreciation

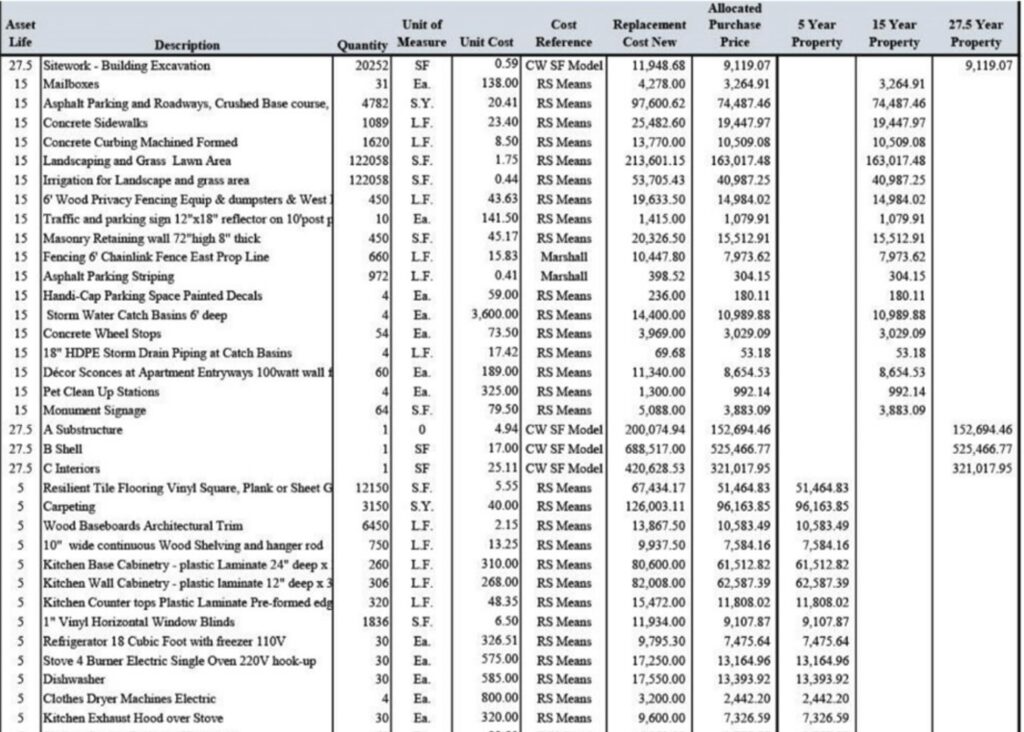

Straight line depreciation is well known among most investors, but bonus depreciation with a cost segregation study is widely underutilized. Bonus depreciation allows you to do a Cost Segregation Study and break out each piece of the building into 5-, 15-, & 27.5-year categories based on their expected life span. The below photo shows the cost segregation for one of our properties.

We purchased this property for $3,360,000. Bonus depreciation allows us to take the full 5-year depreciation amount ($650,426.77) in year 1. This property we bought for a 6% cap rate, so the net income is roughly $200,000. If we take the full 5-year depreciation of 650k in year 1, our income is reduced to -$450,000. Now that huge loss is passed on to owners’ personal taxes and can be used to offset any passive income they have made for the year.

1031 exchange

Depreciation and Bonus Depreciation are not “tax free” just “tax deferred”. Whenever you sell the property, you do incur the tax. Ultimately, you end up paying taxes on the principle gain plus the depreciated basis. That is, unless you do a 1031 exchange. We recently completed a 1031 exchange after selling a 28-unit property in Ferndale and purchasing a 52-unit property in Royal Oak. A 1031 exchange allows you to sell the property, take all the proceeds and purchase a new property, the tax gets deferred until the new property is sold. The caveat is that you have 45 days from the sale of property 1 to identify which property you are buying with the proceeds and then 180 days to close. So, in this case you can continue to buy property, do cost segregation studies, and pay little to no taxes, and then 1031 when you sell. You can do this until you die, whoever inherits the property gets what is called, stepped up basis, meaning that their new “cost basis” is the market value of the property. They can now, in theory, sell the property, take the full proceeds, and pay $0 tax. This is why many times you will see an individual who inherits real estate sell it immediately.

Major Market News

$1 Billion Apartment Purchase in Greater Detroit

Recently in Metro Detroit the owner of a ~$1 Billion real estate portfolio passed away and left his collection of investments to his children. His children recently sold the properties for just under $1 Billion. Check out the article here:

https://www.lightstonegroup.com/press/lightstone-completes-1-billion-apartment-purchase-in-greater-detroit/

Tips and Tricks

Terms

Depreciation – The amount that you can write down as a loss each year based on the amount that was paid for the buildings. This also applies to general business equipment, vehicles, and much more, but in our case, we’re focusing strictly on the real estate aspect.

Tax life – The amount of years that the IRS has determined physical buildings or equipment to reasonably depreciate and allow for paper write offs to reflect this number. The tax code has determined apartments to have a 27.5-year taxable life and commercial property to have a 39-year taxable life.