The Capital Stack

Underwriting Deep Dive #2

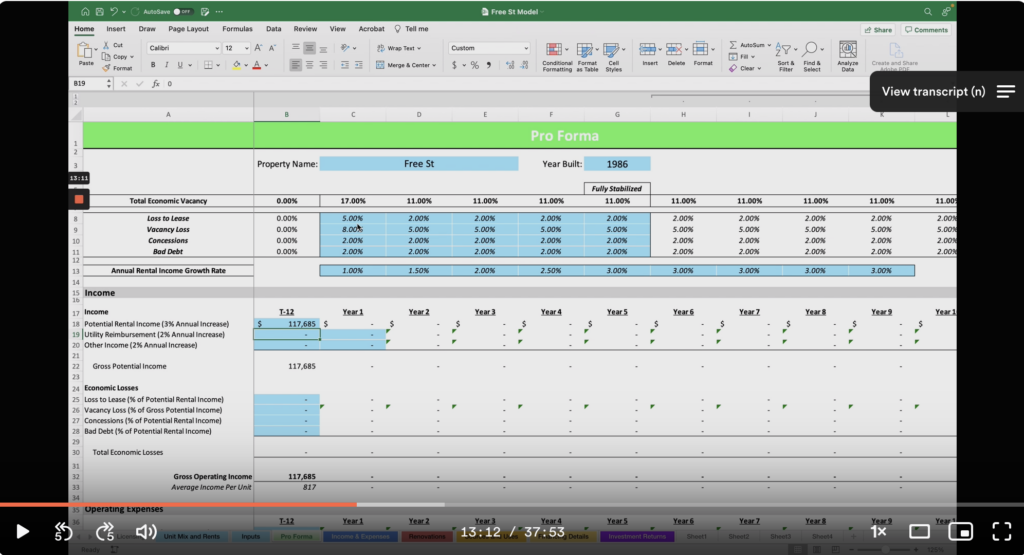

As promised this week’s newsletter will feature an instructional step by step video and inside information on how we analyze a multifamily deal. In the video at the link below we dive into our full model and how we determine good vs bad deal and what we should offer for a property.

Major Market News

Real Estate Lab

The model you saw in the video and the one we use daily was developed by David Toupin’s company Real Estate Lab. We find the model provides us with the accurate and necessary information we need in order to confidently purchase multifamily properties.

Tips and Tricks

Terms:

Cap Rate– Net income / Purchase Price. In the underwriting video above the listing is at a 6.01% cap rate and the asking price is $1,100,000. Using these numbers we know the net income is $66,110. We also look further and there are many costs left out of the expense list which is why in the video I say “6.01% cap rate allegedly” because if we pull market rate costs in for items like property management, maintenance, and others the price is not as great.

Cash on Cash Return– This calculates the annual distribution vs the amount of actual cash into a deal. For example with simple numbers we will typically have a loan of 75% and only 25% of cash down payment. Let’s use $1m property with an interest only loan of 75%.

Purchase price $1,000,000

Loan amount $750,000

Down payment $250,000 (cash out)

Annual net income $50,000

Annual loan payment (5%) $37,500

Annual cash return (NOI – Debt) $12,500

Cash on Cash return $12,500 / $250,000 = 5%