The Capital Stack

IRR Investment Compounding

Compound interest is a powerful financial concept that has the potential to significantly impact one’s financial well-being. Simply put, it’s interest on interest meaning that over time, the interest earned on an initial investment grows exponentially as the interest itself is reinvested. The effect of compounding is often underestimated, but it can make a huge difference in the long-term growth of savings or investment accounts. Let’s take a closer look at how compound interest is generated through an investment in a typical deal that we would buy.

Recently, I was talking to a good friend who made the minimum investment in one of our properties. We began crunching numbers and reviewing hypothetical investments. Our findings were quite fascinating, so I wanted to share some of the details with you.

Hypothetical Scenario:

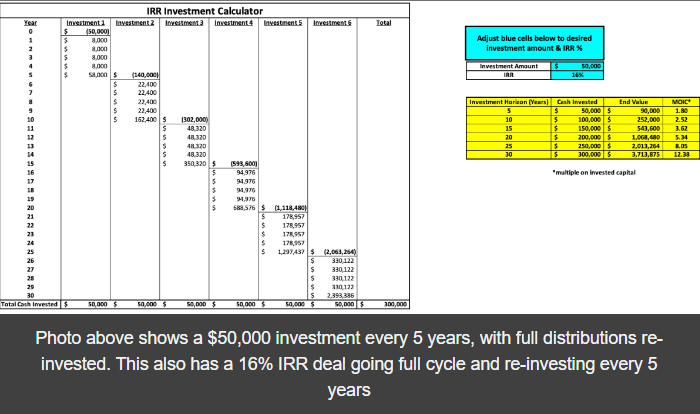

Assume a $50,000 investment into a multifamily deal with a 16% IRR. We typically target higher than 16%, but let’s use 16% as our baseline target.

Now, let’s say you’re 30 years old and make $100,000 after tax income. Cost of living for an average family of 4 is $85,139. So, let’s say you can afford to save $10k per year, and invest $50,000 of additional cash every 5 years. You then fully reinvest all proceeds from these deals and then add your $50k from your savings every 5 years.

Over the next 30 years, you will have invested $300,000 and it will be worth $3,713,875. Or, by year 20, the same year that you turn 50, you can now retire and live off of the $178,957 in annual income that your investments are bringing in. Now you retire at age 50, instead of 62, and become one of the younger ones with the standing tee time at your local Country Club playing golf on Tuesdays at 10am. (If you’re not a golfer, the mid-week, mid-day tee times are viewed as reserved for “the rich & retired”)

I’ve created a spreadsheet that allows you to manipulate the investment amount and IRR, thereby exploring various scenarios and their respective outcomes.

So in summary, start investing, sooner the better, more the merrier, and you too can be one of those people with a standing tee time at 10AM each Monday or Tuesday morning. Even better, you can do it at an age where you still have a shot of qualifying for the US Open. Fran Quinn did it in 2022 at age 57. You can find a summary of the article in the news section below. Imagine what 6 years straight of retirement golf could do for you as you retire at age 50 with an income of $178,957 strictly from your real estate investments.

Newsletter Growth: Road to 5,000

Current Count: 2,398

+17 in the past week!

We are looking to grow our newsletter subscriber list. Currently we have 2,398 subscribers and the goal is 5,000. Since last week’s newsletter we have added 17 new subscribers. Let’s keep it going! If everyone gets 3 people to sign up, we beat the goal and will have something new to reach for. If you can get 3 people to sign up, I am happy to consult or answer any questions for 30 minutes on whatever you may be working on, or interested in. If you hate the idea of talking to me for 30 minutes but enjoy the newsletter, then just share it out of the kindness of your heart! Either way, the sharing is greatly appreciated!

*Have the new subscribers put your name or email in the “How You Found Us” section. *

* We have reached out via email to set up phone consults with all the subscribers whose names have been mentioned in the “How You Found Us” section. If we happened to miss your name, please send us an email and we will get you added to the schedule right away. *

Major Market News

Story of The 122nd US Open

In an engaging article, the PGA Tour documented Fran Quinn’s inspiring journey to the 122nd US Open. As per the report, Quinn, who is 57 years old, generated considerable excitement by becoming the oldest player to make it through the U.S. Open Final Qualifying round. The article quotes “Fran Quinn, 57, had built a buzz as the oldest player to survive U.S. Open Final Qualifying”. His qualification at such an age was a major highlight of that year’s Open Championship.

Read the full article here:

https://www.pgatour.com/article/news/latest/2022/06/15/fran-quinn-57-makes-history-qualifying-hometown-us-open-boston-the-country-club-massachusetts

Tips and Tricks

Tips: It’s never too late & the sooner, the better.

If you get a chance to play around with the excel spreadsheet I put together, you’ll see that after 20 years of compounding you’ll have an annual passive income of just under $100k. This is also only saving $10k/year and investing $50k on top of the initial principle. Realistically, most investors will be accredited making $300,000/year as a couple, and able to save $50k/yr, which leads to $250,000 investments every 5 years. Those $250,000 investments every 5 years compounded with the initial capital, will turn into $18.6million in 30 years at 16% IRR with deals going full cycle every 5 years.

*Nothing in the spreadsheet represents actual deals, only hypothetical investment scenarios with our typical target investment level returns.