The Capital Stack

UYOC VS Cap Rates

In the realm of commercial real estate, the concept of Cap Rates is widely discussed. Many brokers will ask questions like “what cap rate are you looking to buy?”. This helps brokers gauge how much a buyer will pay for a property. My response typically includes seeking a stabilized 8-9% net income based on our total costs, which incorporates not only the purchase price but also renovation, manager/GP fees, loan costs, closing costs, and working capital. For value-add projects, I prefer to embrace a conservative approach to underwriting, hence the use of total cost rather than just purchase price. This is referred to as Unlevered Yield on Cost (UYOC).

It’s worth noting that the markets I invest in usually carry a cap rate of 6.5%. This implies that a property’s annual net income will be 6.5% of its value or purchase price. We want to be sure we are adding value to our properties and making them worth more. For example, an 8.5% UYOC in a 6.5% cap rate market translates to a property’s value being 30% higher than our total cost.

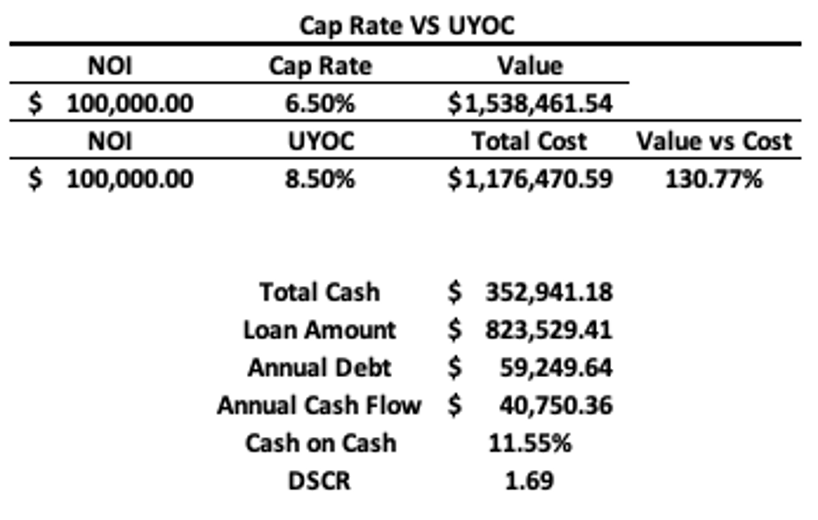

The example below shows 8.5% UYOC in a 6.5% cap rate market.

- NOI = $100k

- 8.5% UYOC means our all-in cost is $1,176,471

- 6.5% Cap Rate means our value is $1,538,462

Cap Rates Don’t Always Matter

The significance of cap rates in real estate investments is often misunderstood. While they are crucial during the selling process, they may not hold as much weight during a purchase. For instance, we may acquire a property with a 4% cap rate that has rents 60% below market. In such cases, the ultimate yield on cost (UYOC) becomes the primary metric of concern, as it determines the cash return before any debt is incurred.

At our company, we adopt a long-term approach towards investing and aim to hold onto properties for several years. Therefore, we prioritize UYOC as it provides a predictable return on investment for our investors. Conversely, when selling a property, many potential buyers tend to focus solely on the “going in cap rate,” seeking to park their money in an asset with a projected return that meets their expectations. However, for those who are not merely interested in parking their money like we are, focusing on the UYOC is a more critical consideration to ensure that we are well-positioned for sustainable returns.

Cash on Cash Return

Cash-on-cash return (CoC) is a financial metric used to measure the return on investment in a real estate property. Specifically, it measures the annual rate of return on the actual cash invested in the property, which excludes the return on any borrowed funds or financing. To calculate the CoC return, one must divide the annual net operating income (NOI) generated by the property by the total cash invested in the property. The cash invested includes the down payment, closing costs, and any other out-of-pocket expenses. The resulting percentage indicates the return on investment in the first year, expressed as a percentage of the cash invested. A higher CoC return indicates a more profitable investment, while a lower CoC return may indicate a less attractive investment opportunity.

Let’s analyze the cash-on-cash return for the scenario we mentioned earlier. let’s assume 70% leverage on our total cost equating $823,529, the annual debt service at 6% and a 30-year amortization equates to $59,250. With an NOI of $100,000, subtracting the debt service results in a net cash return of $40,750 or 11.55% – an impressive annual CoC return.

Such a return allows us the freedom to decide whether to sell, refinance, or hold onto the property. It places us in a position of power and allows us to strategize our exit or refinance plans. If there is a significant drop in mortgage rates, we can opt for a refinance and reap the benefits. Similarly, if the market presents an excellent selling opportunity or cap rates decrease, we can sell and utilize a 1031 exchange to invest our proceeds in a new property without incurring taxes. If there’s a dip in the market, and interest rates and cap rates rise, our return remains unaffected, and we can continue to collect the 11.55% cash return by merely holding onto the property.

Newsletter Growth: Road to 5,000

Current Count: 2,418

+20 in the past week!

We are looking to grow our newsletter subscriber list. Currently we have 2,418 subscribers and the goal is 5,000. Since last week’s newsletter we have added 20 new subscribers. Let’s keep it going! If everyone gets 3 people to sign up, we beat the goal and will have something new to reach for. If you can get 3 people to sign up, I am happy to consult or answer any questions for 30 minutes on whatever you may be working on, or interested in. If you hate the idea of talking to me for 30 minutes but enjoy the newsletter, then just share it out of the kindness of your heart! Either way, the sharing is greatly appreciated!

*Have the new subscribers put your name or email in the “How You Found Us” section. *

* We have reached out via email to set up phone consults with all the subscribers whose names have been mentioned in the “How You Found Us” section. If we happened to miss your name, please send us an email and we will get you added to the schedule right away. *

Major Market News

Offices into Homes

A recent article published by the RealDeal explains the proposal of a new housing bill in California. California Assemblyman Matt Haney has proposed the Office to Housing Conversion Act, a bill aimed at streamlining the conversion of offices into homes and jumpstarting downtown redevelopment. The bill would prevent local governments from blocking or delaying office-to-housing projects. Haney’s proposal comes as many California downtown areas have seen high office vacancy rates due to the shift to remote work.

Check out the full article here: https://therealdeal.com/la/2023/03/03/proposed-bill-would-fasttrack-californias-downtown-offices-into-homes/

Tips and Tricks

Terms:

Debt Service- Debt service refers to the regular payments made by a borrower to a lender to repay the borrowed amount and any interest charges. The debt service payments typically include both principal and interest and are often spread out over a predetermined period. Put simply, this is your mortgage or loan payment.

Pre Debt Cash Return- Pre-debt cash return refers to the cash flow generated by a property prior to the payment of its debt service.