The Capital Stack

The Power of Compound Interest Part II

Compound interest is the 8th wonder of the world, that once understood and put into practice, it’ll be difficult to not think about each activity in your daily life without the effects of compounding, especially when it comes to finances. Simply put, it’s interest on interest meaning that over time, the interest earned on an initial investment grows exponentially as the interest itself is reinvested. The effect of compounding is often underestimated, but it can make a huge difference in the long-term growth of savings or investment accounts. There’s the classic example of doubling a penny every day for a month, resulting in $5.36 million.

A few weeks back our newsletter featured a “hypothetical scenario “ in which we reviewed the effects of compound interest assuming a $50,000 investment and a 16% Internal Rate of Return (IRR). Click to read Compounding Interest Part I.

This week we shift our focus to examining the “Actual Returns” Here, you will discover the real investment returns distributed after the sale of Hollyvillage our most recent full-cycle deal.

Actual Returns

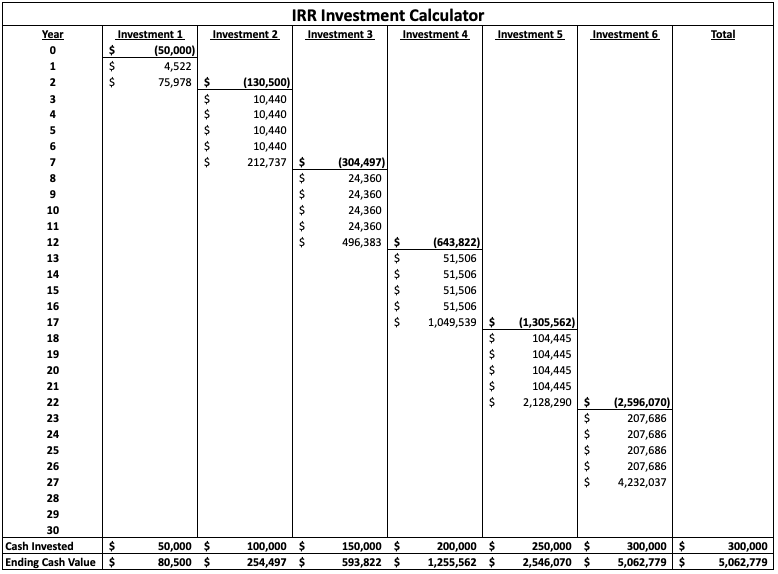

The hypothetical scenario we reviewed in the first part of this series assumed a $50,000 investment paired with a 16% internal rate of return (IRR). The sale of Hollyvillage generated a remarkable 33.53% IRR. Considering the same $50,000 initial contribution, our investor not only regained their initial investment but also earned a notable $30,500 in profits over just twenty months. To simplify further, the investor entrusted us with $50,000, and in just twenty months, we returned to them a total of $80,500, with periodic distributions occurring quarterly along the way.

Hollyvillage significantly outperformed our base metric, setting investors up well for the future should they continue reinvesting. Over the next 28 years, following the same parameters of investing $50k every five years into a base metric of 8% cash on cash and 16% IRR, they will have invested $300,000 and it will be worth $5,090,987, and by year 20, they will be receiving $105,889 in annual passive income.

It’s important to note that while this outcome isn’t assured, it represents the base level target for the returns we seek to deliver to our investors.

I’ve created a spreadsheet that allows you to manipulate the investment amount and IRR, thereby exploring various scenarios and their respective outcomes.

Compound interest is a phenomenon that allows your investments to grow not only on the initial principal but also on the accumulated interest from previous periods. In other words, your money begins to work for you, generating earnings that then contribute to even more earnings. This compounding effect forms a worthy cycle that leads to exponential growth.

Imagine two scenarios: one where you start investing at an early age and consistently contribute, and another where you delay investing until later in life. The first scenario takes advantage of the long time horizon for compounding to truly work its magic. The latter scenario has less time for compounding to take effect, but still has a material impact on the value of the initial capital.

Major Market News

Greystar Buys for $92M

According to an article by TheRealDeal Greystar, a prominent player in the commercial real estate investment sector, has acquired a multifamily complex in Palm Beach Gardens for a significant $92 million. The property has 448 units and was purchased for $205,744 a door. The buyer got a loan for the purchase totaling $72.7 million from Berkeley Point Capital. According to the article the seller of the Palm Beach Property PGIM, “is on a multifamily selling spree. Also this month, the firm sold a 293-unit apartment complex in Plantation for $86 million to a joint venture between Atlantic Pacific Companies and LEM Capital. And last month, PGIM sold two rental buildings in Plantation for $88.4 million to Chicago-based Waterton.” Sounds like “Consolidation Mode” Just on a WAY bigger scale. Check out the article for more information.

Source: TheRealDeal. Greystar buys Palm Beach Gardens multifamily complex for $92M https://therealdeal.com/miami/2023/07/31/greystar-buys-palm-beach-gardens-multifamily-complex-for-92m/

Tips and Tricks

Tip:

Earlier the Better– The magic of compound interest lies in time. The earlier you start investing, the more time your money has to compound and multiply. Even small contributions, when allowed to compound over long periods, can turn into substantial sums.