The Capital Stack

Q&A with BlueSky Capital

This week’s newsletter will feature Kyle Grimm owner of BlueSky Capital. We were introduced to Kyle at a Real Estate Lab event in 2021. Kyle and BlueSky Capital have found success through a diverse real estate portfolio. They focus on purchasing Mobile Home Parks, RV Parks, Campgrounds, & Self Storage.

Tell us about yourself and why you choose to get into real estate?

- In high school, I had no intentions of going to a four-year college nor did I have much direction what I wanted to do career wise. My dad was in real estate back in his 20s and 30s but sold everything once he started having kids and got into the financial services business. He always told me growing up that selling his real estate was one of his biggest regrets. I think that’s what sparked my interest while I was in high school. I ended up buying my first fixer-upper senior year of high school that I’ll tell you about later.

Can you describe your most profitable real estate transaction?

- $470,000 profit in 4 months and 25 days. One of my bankers called me and said a coworker’s wife, who was a realtor, was planning to list a mobile home park about 1.5 hour from me. He knew I bought parks, so he thought he’d reach out. I immediately reached out and set up a showing for the next day with the realtor and sellers. I knew I had an advantage seeing it before anyone else and meeting the sellers in person before they headed back to their home a few hours away. I bought the park for $485,000.I had no intentions of selling the park, but I had a wholesaler reach out who had a buyer. He offered me $955,000 and we closed less than 5 months after I had purchased. I owed 60% of the deal with my dad owning the remaining 40%.It was a great day.

What type of deal do you consider to be your “bread and butter”?

- In the past it has been mom and pop owned mobile home parks in towns less than 50k people.I’ve always had a limiting mindset that there are too many investors in larger markets.I’m still trying to get over that mindset as I grow.I say “in the past” because I have been shifting my focus from parks to storage facilities in similar markets.I also occasionally look at small multifamily, but I would say mobile home parks and storage are my bread and butter.

What marketing strategy has proven most successful to your business?

- It’s all about relationships with mom-and-pop owners. I start with a phone call and follow up with a letter. I might do this for years before I make anything happen with the deal. I use a CRM called Podio and it’s fun to look back at properties I finally close on and read through the conversations I had with them over the years trying to get them to sell. Good ol’ fashion cold calling, mailing, and follow up is my marketing strategy.

Tell us about the first property you purchased?

- Back to senior year high school (2012), I found a house for sale for around $10,000 in the roughest part of my hometown. I ended up offering them $5,000 for the house which they accepted. With the help of my dad and a good friend, I fixed it up over the next year and then rented it out. When my first tenant, Leroy, handed me that first $500 rent check, I was hooked. I was lucky to have a dad who was very handy and taught me how to lay flooring, fix drywall, paint, etc. The lessons I learned from those first few deals were invaluable.

How has the current market (increased interest rates) affected your business?

- I am experiencing a situation currently where a seller had an appraisal on a MHP a few years ago who is still stuck on that price. It takes educating some of the mom-and-pop sellers how much raising rates effect the value of their property and how much I can pay. I have had to walk away from multiple deals due to this. I am much more cautions with my underwriting with not knowing exactly how much more rates will increase.

Can you share three important things you have learned being in real estate?

- “Don’t get stressed out until tomorrow”. Whenever things seem to be hitting the fan, I tell myself that I can stress out about the situation tomorrow. But today, I must press forward and fix the situation.

- This is a people business. Especially with my focus on smaller markets, your reputation is everything so make sure you treat people right. Which includes your tenants!

- It gets easier the bigger you get. No, money doesn’t buy you happiness. But it sure helps fix problems like bad water heaters, clogged toilets, unexpected snowstorms, etc. The little things use to stress me out because my cashflow was so thin. But the more I’ve grown, the easier it gets to solve the problems.

What about your job do you find the most challenging?

- With buying MHPs in smaller towns, 3rd party management is not an option. I have self-managed from day one. Dealing with people can be the most challenging but also the most rewarding.

Can you share one of your goals for 2023?

- Implement the EOS operating system which is found in the book Traction. If you are in business or real estate, the book is a must read!

Pick your favorite deal:

- How did you find it?

- Back in 2019, a friend of mine told me about an auction sign he had seen in front of a 36-space park in a town 20 mins from me. It was a small-town auctioneer who was doing zero advertising other than the sign. I knew it could be a gold mind.

- What did you like about it?

- Built in 1993 (very new for a MHP) it had all pvc water/sewer lines, asphalt roads in great condition, and best of all, every home had its own water, gas, and electric meter that were directly billed to the tenants. Meaning I would be paying zero utilities.

- What was the business plan?

- The plan was to fill the remaining six lots with homes, reseal the asphalt, start enforcing rules/regs, and getting the overall appearance up.

- How was it financed?

- We financed this at a small local bank with 20% down amortized over 20 years at 5.8% interest. This was another deal where I owned 60%, Dad owned 40% with no outside investors.

- How’s it going today?

- We paid $372,500 for the park and have had virtually no big expenses other than your typical lawncare, snow removal, and occasional tree trimming. It’s running smoothly and we are under contract to sell the park today for well over 1mm. It will be a hard one to see go.

Kyle’s most profitable real estate transaction achieved earning of $470,000 in just over 4 months! What an incredible return. You can follow Kyle’s success on the following platforms.

YouTube-https://www.youtube.com/@kylegrimm

Twitter- https://twitter.com/KyleLGrimm

Instagram-https://www.instagram.com/_kylegrimm/

LinkedIn-https://www.linkedin.com/in/kyle-grimm-1aa207132/

Newsletter Growth: Road to 5,000

Current Count: 2,353

+118 in the past week!

We are looking to grow our newsletter subscriber list. Currently we have 2,353 subscribers and the goal is 5,000. Since last week’s newsletter we have added 118 new subscribers. Let’s keep it going! If everyone gets 3 people to sign up, we beat the goal and will have something new to reach for. If you can get 3 people to sign up, I am happy to consult or answer any questions for 30 minutes on whatever you may be working on, or interested in. If you hate the idea of talking to me for 30 minutes but enjoy the newsletter, then just share it out of the kindness of your heart! Either way, the sharing is greatly appreciated!

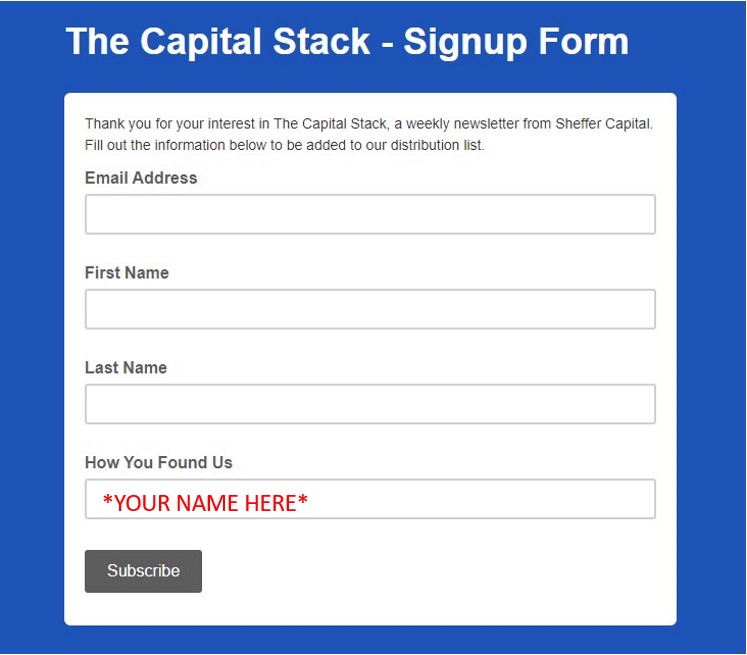

*Have the new subscribers put your name or email in the “How You Found Us” section. *

* We have reached out via email to set up phone consults with all the subscribers whose names have been mentioned in the “How You Found Us” section. If we happened to miss your name, please send us an email and we will get you added to the schedule right away. *

Major Market News

Traction by Gino Wickman

In Kyle’s interview he mentions one of his goals for 2023 was to implement the “EOS operating system”. This system is explained in the book titled Traction. EOS stands for Entrepreneurial Operating System. The books website quotes “EOS is a simple framework for defining what’s important, who owns it, and exactly what success looks like. With every member of your team accountable for a handful of goals and numbers, you’ll get consistently better results.”. We asked Kyle to explain the EOS system to us and he quotes “The EOS system helps your entire team stay accountable to not only the overall goals of the company, but their specific goals and targets.” Link to the book below.

Traction By Gino Wickman-https://ginowickman.com/books/

Tips and Tricks

Tips: “Good ol’ fashion cold calling, mailing, and follow up” still work.

Similar to ours, Kyle’s marketing strategy consists of “cold calling, mailing, and follow up” . We commit to 10+ hours of cold calling a week and several hundred mailers a month. We know from experience these methods are very effective.