The Capital Stack

Officially Closed Suburban 36

8 Months since we first gained contact with the seller and 2 months since our signed PA we are excited to have officially closed on the Suburban 36 portfolio!

What’s Next

Directly after closing there are always a few housekeeping items that need to be addressed. We will start by ironing out the final details with the property management company and directing the properties bills and rent payments to us. We will work with our property management company to design and install new signage at each property.

Both properties are currently 100% occupied. We will begin increasing rents as current leases expire. The best part is all 36-units are already mostly updated. This means we will not need to manage or incur much expense to achieve our target rents. We are targeting $1,300 for a two-bedroom unit and $1,500 for a three-bedroom unit at the Donovan Townhomes (South Lyon). At Plymouth Gardens (Plymouth) we are targeting $1,200 for a one-bedroom unit and $1,400 for a two-bedroom unit. There are early indicators that we may be able to exceed our projected rents. We are excited to see how it pans out.

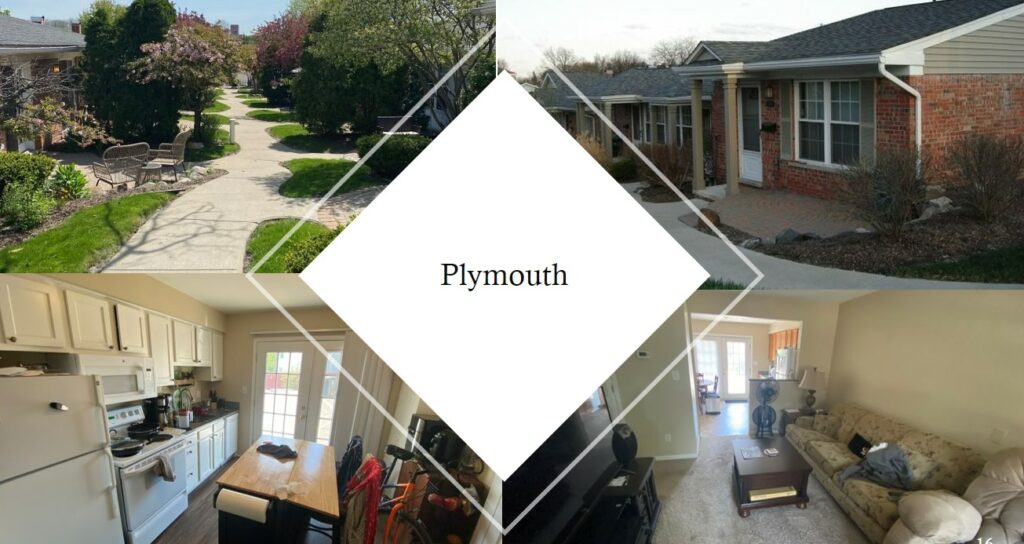

Plans for Plymouth Gardens

Plymouth Gardens will get a sign put in to bring recognition from the local traffic to the apartments. We are right next to a condo property so many probably assume our property consists of condos for sale rather than apartments for rent. As these units turn we will do a light refreshment with new flooring and paint to brighten up the units and bring them to market to rent. We anticipate a lot of residents staying at the property as well as most have been there for a while.

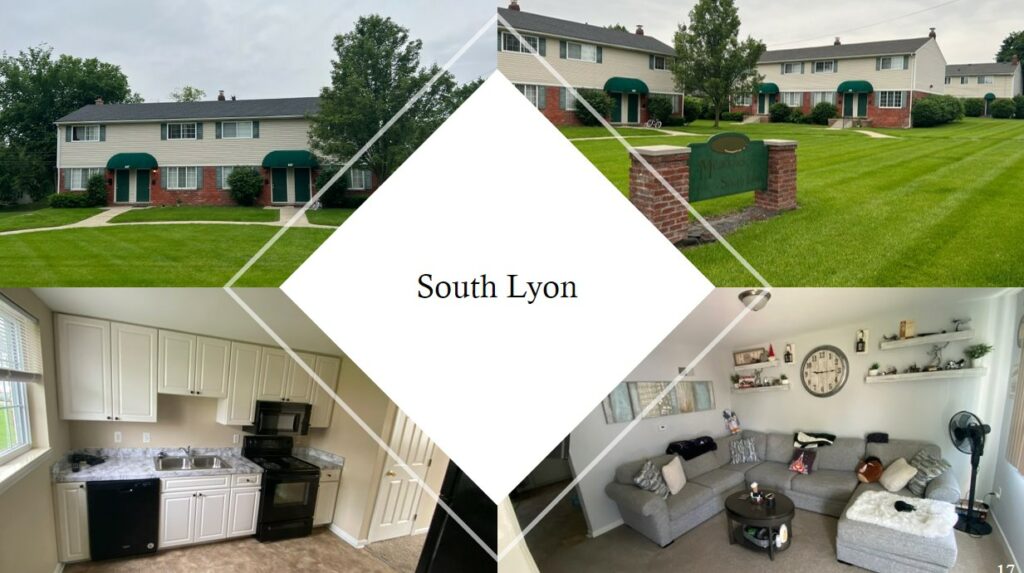

Plans for the Donovan Townhomes

The Donovan Townhomes include two private entry spaces. One space (~420 sf) is currently being used for storing maintenance equipment and the other space (~250 sf) contains coin operated washers and dryers. Our new maintenance crew will not need any onsite space. As for the laundry room it has not been used in years, as all units besides 2 have in-unit laundry. We plan to convert both spaces into two additional studio apartments. This conversion should be simple as the units already have plumbing and electricity. Adding 2 studio units which will lease for ~$2/ft will add an additional ~$150,000 to the value of the property at a cost of ~$40,000.

The Capital Stack

The highlights of this purchase are in the debt terms. The official loan amount was $3,880,000. We raised $1,500,000 from investors including our coinvest. We locked in seller financing with a 5-year term at a 4% interest rate and 80% LTV. These excellent financing terms represent a cash flow surplus of ~$48,500 per year rather than being paid towards debt service.

Major Market News

Multifamily Syndication

A major real estate syndicator, Scott Everett was featured on Chris Powers’ very popular podcast. According to the show notes “Scott discusses how he got started in value add MF and grew to 38,000 units”. Scott has been in the business over a decade and is still only in his early 30’s. They recently purchased 4,455 units across 14 properties in DFW and Houston. We like a lot of Scott’s approach to large scale value add real estate. Link to podcast below.

Link-https://podcasts.apple.com/us/podcast/the-fort-with-chris-powers/id1410549811?i=1000556262507

Tips and Tricks

Quick Tip:

Maintenance Areas

A lot of “Mom & Pop” owned properties have an onsite office or storage room of some sort so the owner who self manages doesn’t need to store extra materials at their home. While typically this will be a shed or basement, in this case we were lucky that the rooms are set up so well for a quick conversion. We have offsite management that operates with stocked items in the maintenance vehicles so we’re able to capture the value of this extra square footage. These units also have plumbing and electrical which is an expense the owner was bearing and we will now transfer that to the new tenants who move in. A lot of owners won’t even realize this value exists because this is how they’ve always done things. In this case for Donovan Townhomes we will add another ~7% to the property value based on our purchase price.