The Capital Stack

CoStar

CoStar is a great asset that we use daily. When a deal is referred to as ” on market” that means it is listed for sale on CoStar, Loopnet, or Crexi. CoStar has the most accurate data that I’ve found and is for commercial real estate what Zillow is for residential real estate. We also use CoStar to obtain comps and determine the average pricing for a given area. According to CoStar’s website CoStar gives access to 6.7M+ properties across all major asset types.

Here is what we do to search CoStar for a Southeast Michigan deal:

- Select the State of Michigan

- Listing type active

- Property type multi-family

- Existing (already built, not proposed)

- This leaves us with 207 properties

- Many options available in Detroit, Garden City, Redford.

- We do not choose these because we are targeting $55k+ median income, $250k+ median home value

- Potential option, a 12 unit in Fowlerville. 209-217 Free St, Fowlerville ($56,276 household income, $276,334 home prices)

Market Research

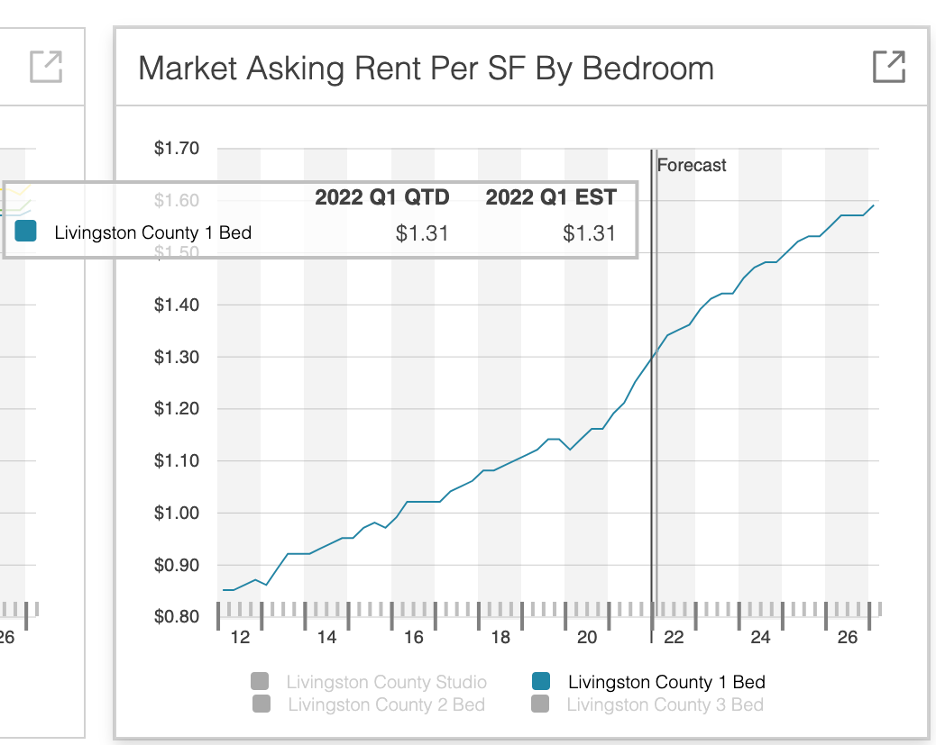

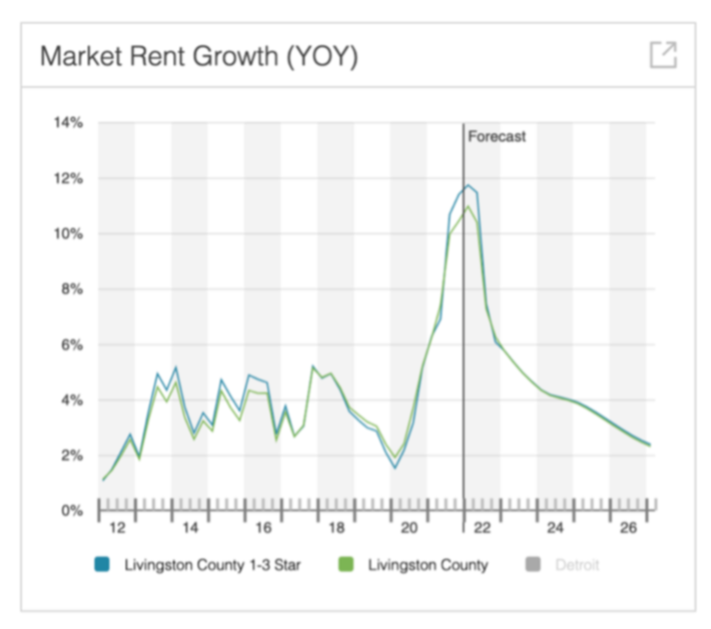

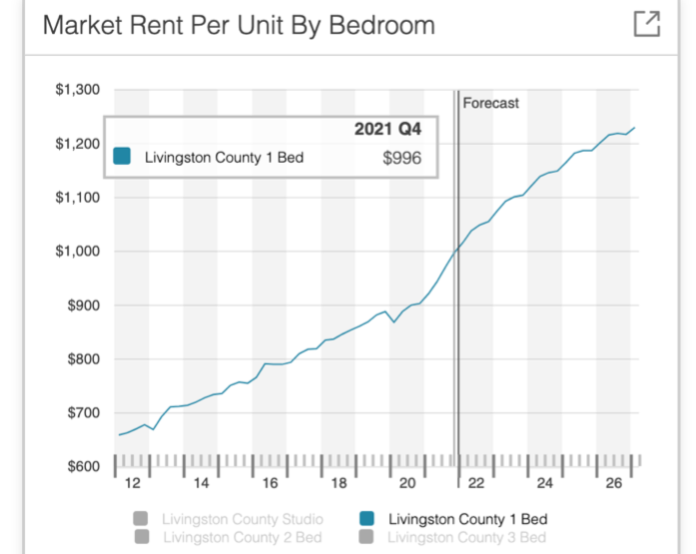

Because CoStar’s inventory is substantial, we have learned to complete a basic analysis on the property before running the deal through a complete analyzer. The 12-unit property in Fowlerville looks promising. It meets our standards for income and home values in the area. Fowlerville is a growing rural region. As Livingston County homes increase in price, home buyers are driven west to Fowlerville. Fowlerville has seen a 13.7% home value increase in the last year and market rent is up over 10% in the last year. CoStar tells us the one bedroom market rent is $996 and $1.31 is the market rent per square foot.

There are a few negative points we notice as well. For starters, all 12-units are 1-bedroom. 2-bedroom units lease much faster in Livingston County. The extra bedroom opens up possibilities for younger people in the market to have a roommate and families to have a room for kids. Secondly, our initial reaction to the price is that it seems a bit high. The seller is asking $152 per square foot which is high considering we could build a brand new building for $140 per square foot. It’s also listed at a 6.01% cap rate. This cap rate is in line with what we would see a property selling for in Livingston County, but Fowlerville is not the best located of cities in the county. Fowlerville is in the path of development but it is still not as strong as Brighton, Hartland, or Howell. (Brighton $387,868 median home value for comparison).

“Napkin Numbers”

Although the price for this property seems high. It is in a growing location and could be a traditional value add opportunity so we will complete what we call “napkin numbers”. These are rough numbers analyzing the rent roll, market cap rate, and OpEx (Operating Expenses). The results of the napkin numbers help us determine if it is worthwhile to contact the broker and obtain the full financials for the property. Let’s complete napkin numbers on the 12-unit property that looks promising in Fowlerville.

The average rent for the building is $760 per unit which is $1.27 per sf. If you remember the market rent per sf is $1.31. This allows us just $0.04 per sf of rent growth and therefore increase value. Our analysis would stop there, and the property would be a quick NO. The rents are too close to market value for our typical business plan. The potential total increase in property value is $57,600 which would not support a refinance to return equity to investors anytime in the near future.

Napkin Numbers

- $0.04 x 600 square feet = $24 per unit rent growth

- $24 x 12 units x 12 months = $3456 annual income increase

- $3456 / 6% cap rate = $57,600 increase in property value

Our Offer

According to our brief review the most we would want to pay for the property is $750,000. This will allow enough room for around 50k of renovations as well as all other fees and costs associated with closing and we think it would be worth ~$1.2m with full rent growth in place. Considering the property is listed for $1.1 million, at this time, we believe the asking price for the property and the price we are willing to pay for the property are too far apart. On to the next one!

Major Market News

| Multifamily Market According to a article by MultifamilyDrive who quotes RCA “$201.3 billion worth of apartments were sold nationally in 2021”. The article continues by informing that the previous all-time high was $193 billion in 2019. The article predicts that 2022 is going to be another very competitive year to buy and sell multifamily real estate. The article attributes the thriving market to the increase of rents and quotes “As rents boomed, so did apartment sales. The significant rent increases drew investors into the multifamily business from other real estate sectors and around the globe in 2020.” You can read the full article here https://www.multifamilydive.com/news/how-higher-rents-rising-values-will-drive-multifamily-construction-in-2022/619158/. |

| Tips and Tricks |

| Check out some popular real estate terms: OpEx: Operating Expenses. These are expenses that you could expect to have every year when owning a property. A few examples would be as follows: 1.Utilities 2.Insurance 3.Taxes 4.Property Management Fee 5.Repairs & Maintenance Cap Rate: Capitalization Rate. This is the most widely used metric to determine commercial property values. Typically, the strongest markets in the US would have properties selling for 4-5% cap rates and midwestern markets would be in the 7-9% range. This past year we’ve seen deals in Phoenix, Austin, and Miami selling in the 2.5%-3% cap rate range. Here’s the effect of those numbers. Midwest property: $150k NOI 6% cap market = $2,500,000 value Phoenix property: $150k NOI 3% cap market = $5,000,000 value Cap rate: is the amount of net income the property makes compared to the purchase price. For example, the Fowlerville property we discuss above is listed at a 6.01% cap rate. We don’t know the exact NOI, but can get to it easily using the cap rate noted in the listing. Purchase Price x Cap Rate = NOI so $1,100,000 x 0.061 (6.01%) = $67,100. If we buy the Fowlerville property that is the amount we can expect to net after all OpEx and before our mortgage payments. |