The Capital Stack

14-unit mixed use, Ferndale, MI.

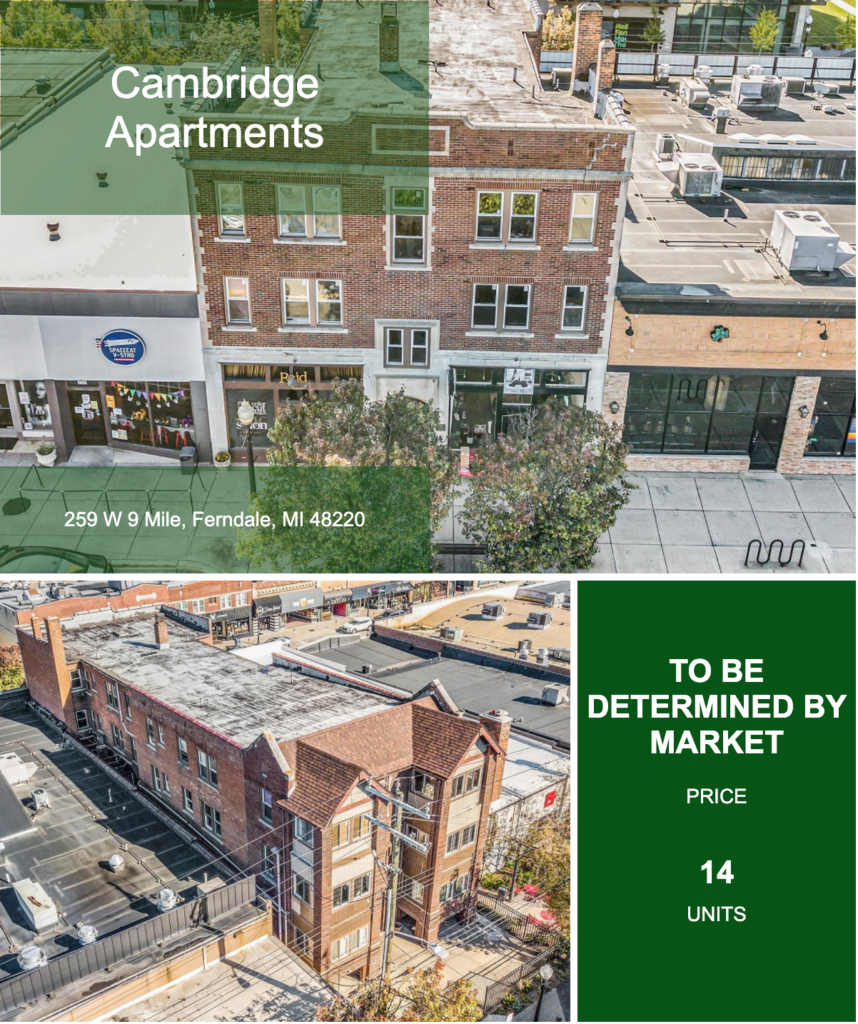

Cambridge Apartments

We are under contract on a 14-unit mixed use property named the Cambridge Apartments. This property is in Ferndale MI. It is located on one of the best streets in town and is a very walkable location. It is close to 1-75 and Hwy 696 which gives access to several large employers. The location also allows for a quick commute to Detroit MI. The property consists of 12 apartment units and 2 commercial/retail spaces. The unit mix consists of 5 1-bed 1-bathroom units and 7 2-bed and 1-bathroom units. The entire building is occupied except 1 unit. Both retail spaces are occupied as well.

How We Found the Cambridge Apartments

Cambridge Apartments will be the 2nd deal we have bought through a marketed broker process. This opportunity first hit our email as a broker email blast. The broker is someone we knew but had not bought or sold anything with yet.

Immediately I sent it over to two partners who we’ve done several deals with, in this market. The size and scale looked like a perfect JV opportunity. They both said they were in, and I sent an offer based off quick napkin numbers for $1,250,000 to the broker to let him know we were very interested. The listing was unpriced which is common in commercial real estate. The broker let me know that the seller was hoping to achieve ~$1,750,000 as a sales price.

We went back to our underwriting and determined we could pay $1,500,000 for the property. We revised our offer and sent it to the broker so he could present it to his seller.

The broker let us know that he had several offers. One as high as $2m. We weren’t willing to compete with this offer. The seller accepted the other buyers offer for $2m and we considered it a dead deal. Two weeks later the broker called and said the buyer had reduced their offer to $1,750,000 after a quick inspection. Several days later the original buyer who started at $2M had pulled out altogether.

Because of our familiarity with the broker and his knowledge of the deals we have bought and sold in the market he was able to show the seller that we are strong buyers and when we get a deal accepted, we will close. Surety of close is often more important than price in today’s market. Sellers do not want to waste time with a buyer that will pull out over small items like the first buyer did in this scenario.

Offer verbally accepted, we sent over our purchase agreement. After 3 weeks of attorney back and forth, the seller did not like many of the standard terms that we included in the PA for our protection. The seller decided not to sign the PA. This is time #2 we considered it a dead deal. At this point we had a few thousand dollars of attorney expenses considered wasted at this point.

About a month after that, the broker came to us another time and said he had discussed with the seller, and he was now willing to accept our PA. This time went smoothly and we now have a signed contract, are through due diligence, the property appraised for $100k over our purchase price, and we will close in 2-3 weeks.

Our Business Plan

Because the building was built in 1940 we knew there would likely be some deferred maintenance and items that needed to be updated. Upon closing our plan is to immediately replace the roof. As current leases expire, we will update all the interiors with a high-end renovation including quartz counters, new cabinets, and refinishing the original hardwood flooring.

How it’s Going Today

We have completed all due diligence including a detailed building inspection, environmental study, and appraisal. As expected the buildings inspection confirmed some deferred maintenance but no more then we had accounted for in our underwriting. At this point we only need to wait for the loan to complete the underwriting process and we plan to close in 2-3 weeks.

The Capital Stack

The purchase price we are paying for all 14-units (12 residential, 2 commercial retail) is $1,500,000. We are planning for just shy of $600k in renovations. Our loan will be for 80% LTC. We are bringing a total $600k of investor capital from three investors to complete the full Capital Stack of $2,280,000.

Major Market News

| Retail into Rental? According to an article by TheRealDeal. The explosion of rents is motivating developers to build multifamily properties. The article says there is a shortage of land that’s desirable to build on, therefor developers are turning to retail spaces and repurposing them into multifamily properties. The article quotes “For multifamily developers put off by the shortage and rising price of open land, those vacant spaces are ripe for investment.” The “vacant spaces” the article mentioned are retail and entertainment spaces that have gone out of business because of Covid-19. You can read more details using the link https://therealdeal.com/2022/04/04/4417676/36(11.4%). We currently do not have any plans to repurpose the 2 retail units that make up the street level floor of the Cambridge Apartments. However, the concept is very interesting to look into and read about others making these changes. |

| Tips and Tricks |

| Tips- Complete thorough underwriting on the property you may purchase. Gather and use as much accurate information as available to you. Then, STICK TO YOUR NUMBER’S. Our purchase price of $1,500,000 is the exact dollar amount that is logical for us to pay for the Cambridge Apartments based on the returns we strive to deliver for investors. As this week’s newsletter explains we were willing and did let the deal fall through 2 times in order to get the terms and purchase price that we feel comfortable purchasing the property with. |