The Capital Stack

What to Expect When Investing With Sheffer Capital

Sheffer Capital’s Guarantee

Sheffer Capital strives to provide its current and future investors with profitable investment opportunities and above average returns. We are committed to answering any questions and maintaining clear and consistent communication with our investors throughout the life of a deal.

What to expect when investing

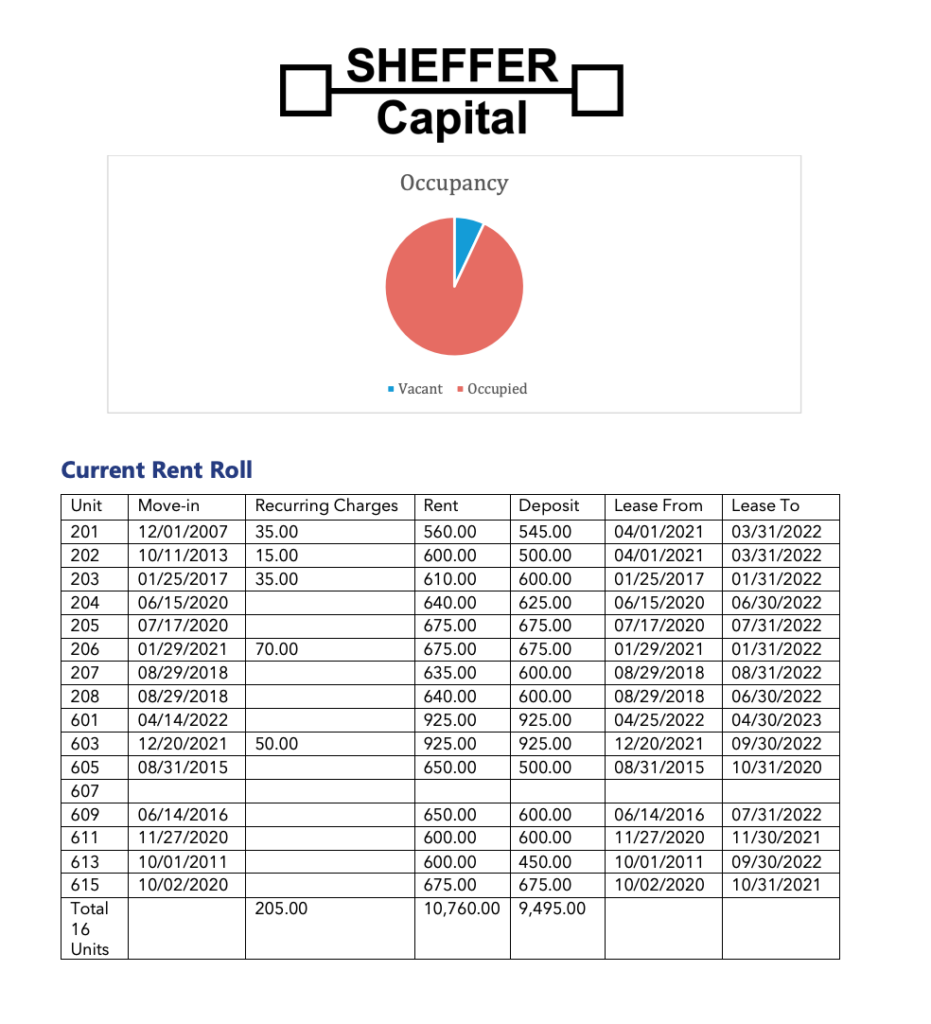

The photos shown above are an example of the investor updates that we send out monthly. These updates keep our investors informed on any renovations or maintenance we are completing at the property. They also let the investors know the current occupancy rate and provide the most up to date rent roll. In addition to the monthly report investors may receive an unscheduled update if something significant were to take place.

On a typical deal we will do quarterly distributions. We send all distributions from Investnext. Investnext is a portal that all of our investors have access to. This portal allows our investors to track the total amount they have invested with Sheffer Capital and the total return on their investments. The portal is also where all documents will be signed through as well as K1’s and any other pertinent information is uploaded so investors can easily track their investment all from one central spot.

Investing in real estate is a long-term plan and is very illiquid. It is best not to invest money that you may need on short notice. Many people choose to invest with a self-directed IRA for this reason, as they do not plan on having access to the funds for many years. We purchase properties with the intention of holding them for 5 to 10 years and sometimes longer. With that being said, we constantly monitor our portfolio and If an early exit strategy on a particular property is extremely lucrative we will certainly take advantage.

How It Works

- When we go under contract on a new deal, we send an email to our newsletter list. This list consists of repeat investors and individuals who have yet to invest with Sheffer Capital. The email contains a link to the investor portal where a potential investor has access to the properties OM, financials, and underwriting.

- An individual interested in investing can reserve their investment and sign documents through the portal. We are happy to answer any questions or make any clarifications that may be necessary.

- Once deciding to invest an investor will use the portal to choose their investment amount and create their account. An investor can invest as an individual, or with an IRA or LLC and several others which are less common.

- Once the investment account is created and the documents signed an investor will then be able to fund the investment via ACH or a wire transfer. The funds will be sent directly to the new property specific LLC bank account.

- Once an investment is filled and we close on the property the monthly updates and quarterly distributions will begin. Distributions will begin after closing at the end of the first full quarter. For example, if we close in November which is the middle of Q4 the first distribution will be in April which is the end of Q1 in the following year.

- You are now a part owner of a new property and can follow along with questions as much or as little as you’d like.

Major Market News

| Active VS Passive Investments? When investing in Multifamily real estate there are two popular options. One can choose an active investment or a passive investment. An article by Forbes does a good job of describing both options. The article describes active investors as those who will “find a property on their own. Once identified, they also need to underwrite it, perform due diligence, arrange financing, get the deal closed and manage the asset once the purchase is complete”. The article continues to explain that investing actively “requires a significant amount of expertise, time, resources and relationships to do it well.” Sheffer Capital is an active investor in real estate and our investors are considered passive investors. The article describes the benefits of a passive investment and says “a passive investment provides investors with the benefits of multifamily ownership without the hassle of actually managing the property. This provides them with passive income so they can use their time to pursue other interests.” You can read more about both types of investments here https://www.forbes.com/sites/forbesrealestatecouncil/2021/06/24/benefits-of-passive-multifamily-investment/?sh=536d22f6c747. |

| Tips and Tricks |

| Check out some popular real estate terms: Tips: If you have interest in a deal that we have under contract, let us know as soon as you can. Often funding for deals is filled in just a few hours. We will always send a “Fully Subscribed” email out as well indicating the closing of the capital raise. There is the rare occasion that other things in life get in the way and an investor drops out later in the process. In this scenario we would send an email notification with details on the amount newly available and any new or existing investors are welcome to take the spot. Quarterly distributions: Quarterly distributions are 4 times per year. This is for the total amount of distributable cash flow after all expenses, debt payments, asset management fees, and reserves. Our monthly books close on the 10th of the month after, so distributions will go out in the week following the 10th of those months. K1: A K1 is a form used for your taxes on the investment which reports earnings, losses, and dividends paid out from your investment. This will typically show a sizeable loss in the first year as we utilize depreciation to offset our gains from cash flow on the property. |