The Capital Stack

What is Consolidation Mode?

Why are we Doing It?

If you have been following along, you may have noticed our current focus is on both buying and selling properties. We refer to this approach as “consolidation mode”, which involves selling off the smaller properties we own and focusing on acquiring properties with a larger unit count in more desirable areas.

From 2020 to 2022, our focus was on identifying profitable opportunities and acquiring properties that offered substantial returns and align with our financial objectives. Our value-add strategy, which involves property renovations, expense reduction, and revenue enhancement, has been successful in increasing the value of these properties by 50-100% of their purchase price within 2-3 years. As a result, we have determined that three of our properties, Creekside at Fenton Heights, Hollyvillage Apartments, and Pinehurst Apartments of Linden, could benefit from an early exit due to the significant improvements made.

Advantages of Consolidation Mode

Return On Equity: We have opted to briefly depart from our standard method of acquiring and retaining properties and instead pursue an early exit strategy for a select few. Our primary motive for this decision is to capitalize on the significant equity we have built in each property. For instance, using round and small numbers let’s consider a stabilized property that yields a 10% cash on cash return. Suppose we purchased the property for $1 million, using $300,000 of investor capital and a $900,000 loan, some of which were utilized for renovations, resulting in an all-in cost of $1.2 million. After renovation, the property’s value has increased to $1.7 million due to the higher rents we achieved. At a 10% cash on cash return, our annual earnings are $30,000. Consequently, our total equity stands at $800,000 ($1.7 million – $900,000 = $800,000), leading to a return on equity of only 3.75% (30k / 800k = 3.75%). Therefore, we have the opportunity to invest this $800k in a new deal that will yield a stabilized 8% cash on cash return, resulting in $64,000 in earnings, more than twice the present actual cash distributions. Although entirely hypothetical, this scenario serves as an excellent illustration of how cashing in on built equity can be an incredibly powerful tool.

Larger Assets for Long-Term Profitability: When comparing the management of a 16-unit property generating $30k in annual cash flow to a 50-unit property generating $100k in annual cash flow, the processes involved are very similar. Therefore, shifting our focus to the acquisition of larger assets can offer sustained growth and profitability over the long run, and will allow us to make the most efficient use of our time and investor capital.

Consolidation Mode In Action

On The Sell Side: Here’s where we are in the process. Pinehurst is currently under contract. Hollyvillage was under contract, but unfortunately fell through, is continued to be offered for sale. Lastly, we have chosen a brokerage to represent the sale of Creekside at Fenton Heights and expect it to hit the market early next week.

Despite our optimism, we recognize that deals can fall through unexpectedly. Therefore, we are not counting on any of these transactions until the day of closing. However, we are pleased with our progress thus far and remain hopeful for a successful outcome.

On the Purchase Side: We are on the verge of finalizing multiple deals with similar characteristics. These deals involve properties ranging from 20 to 80 units, situated in Michigan’s Class A/B suburbs. The current rental rates for these properties fall in the mid-$800s range. We have identified a significant opportunity to enhance the market value of these properties through cosmetic upgrades costing ~$12,000 – $15,000 per unit. Similar properties that have undergone such upgrades are currently being rented at rates ranging from $1,100 to $1,800 in the same markets.

Looking ahead, we have a positive outlook for the second half of this year. Despite the challenging macroeconomic conditions, we have experienced strong collection rates. Loan rates have also decreased and slightly stabilized in the 5.5-6.5% range. Additionally, the current news cycle and talks of a recession could potentially encourage passive property owners to sell their assets. Overall, we believe the current environment is working in our favor and anticipate a very strong 2nd half of the year.

Newsletter Growth: Road to 5,000

Current Count: 2,482

+21 in the past week!

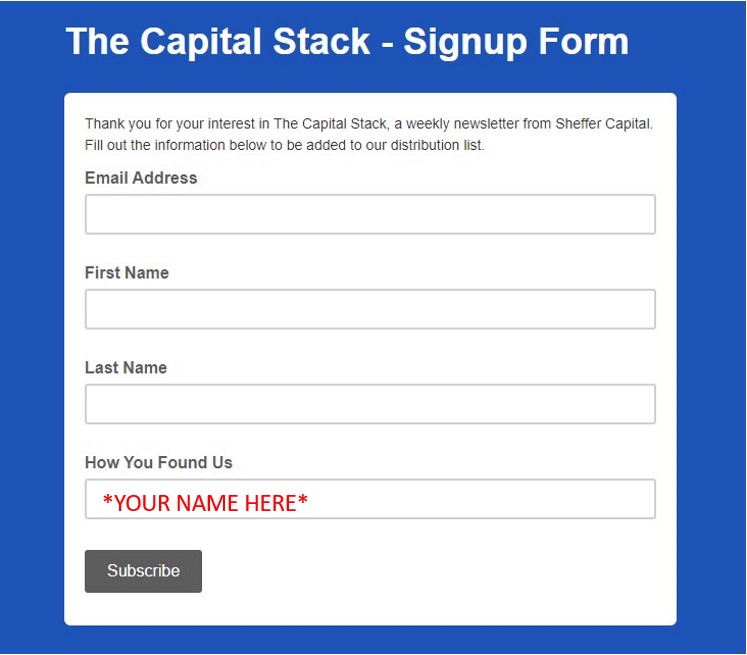

We are looking to grow our newsletter subscriber list. Currently, we have 2,482 subscribers and the goal is 5,000. Since last week’s newsletter, we have gained 21 new subscribers. We are committed to delivering informative and valuable content to our readers and look forward to continuing to do so in the future. Your encouragement and feedback inspire us to keep improving and providing high-quality insights on various topics. Sharing our newsletter on your social media platforms can help us reach a wider audience and grow our community. Your support means a lot to us, and we look forward to bringing you more helpful insights. Thank you!

Major Market News

Northland Properties Purchases for $504 Million with 1031 Exchange Funds

According to an article by ReBusiness online Real estate investment firm Northland Properties has acquired the Thea at Metropolis luxury apartment tower in Downtown Los Angeles for $504 million. The 685-unit property was completed in 2018 and offers a variety of high-end amenities, including a fitness center, rooftop pool, and dog park. The article quotes “The majority of the equity invested in THEA came from Northland’s disposition of Hilands, an 826-unit property in Tucson, Arizona that the firm acquired for $21 million in two purchases in 1992 and 1997 and sold earlier this year for $178 million.” Below is a Link to the full article by Rebusiness online and an interesting Twitter thread by Northland Properties CEO regarding the recent exchange.

Article: https://rebusinessonline.com/northland-acquires-thea-at-metropolis-luxury-apartment-tower-in-los-angeles-for-504m/

Twitter Thread: https://twitter.com/MRossG199/status/1590108866687078400?s=20

Tips and Tricks

Terms: Return on Equity VS Cash on Cash

Return on Equity (ROE) and Cash on Cash (CoC) returns are both widely used metrics in real estate investing. ROE measures the amount of return based on the total equity in the property, while CoC measures the cash flow generated by the property in relation to the amount of cash initially invested.

When you first buy a property, the metrics will be very similar as the equity equals the cash investment. However, after renovations are done and revenue rates are up, ROE will drop while CoC will increase. Our goal is to balance both of these with hitting a great CoC return and making sure that our equity in each property is not underperforming vs another investment property that we could acquire and move the funds into to earn a higher actual cash return.