The Capital Stack

Market Analysis

As multifamily developers we often receive questions regarding the existing real estate market as well as the upcoming real estate market. Our answer has remained the same for some time now. We continue to purchase our usual class B assets in A+ locations with confidence. Continue reading for more information.

Interest Rates

The interest rate on the loan to purchase a property can make or break a deal. In today’s market interest rates are increasing. Just a few months ago we experienced interest rates in the 3’s. Rates this low are simply not sustainable and were never expected to continue long term.

We aren’t overly concerned with the recent increase of interest rates because as a rule of thumb we lock in long term debt and include inflated interest rates while underwriting all our properties. We recently planned to refinance our property in Fenton and had hopes of returning 50% of our investor’s proceeds. Unfortunately, the bank changed the terms from 5.09% to 5.75% which reduced the proceeds to the point that the refinance was no longer worthwhile. Because we lock in long term debt and buy properties with the intention to hold them for many years this refinance was more of a bonus then something we needed. Locking in long term debt allows us to be patient during this time. We have 10 year debt on the property at 4%.

If you have been following our newsletter you will have heard about the Suburban 36 portfolio we currently have under contract. One of the best parts about this acquisition are the financing terms. The seller has agreed to finance the purchase at a 4% interest rate. With rates as they have been, every time we mention our financing on this deal to someone else in the industry, their ears perk up and say “wow great job” as they realize how big of a win 4% financing is in today’s market.

Prices

When interest rates were in the 3’s the demand for properties sky rocketed and sellers were able to get top dollar when selling their properties. With the increase in rates buyers are forced to slow down but sellers are still expecting top dollar. Consequently, sellers and buyers are often not able to agree on price. This is leading to many buyers “sitting on their hands” and waiting for the dust to settle.

Because we buy and hold long term our portfolio is un-effected by the sales market. We are able to continue focusing on driving rents to market and operate well. Many investment groups buy with a 2–5-year debt and 3–5-year hold period. If investors use this strategy and their debt becomes due at a non-opportune time they may be forced to sell or refinance and will hurt the most.

Rental Rates

In relation to housing prices, rental rates still lag. Let’s look at the Suburban 36 portfolio located in Plymouth and South Lyon as an example. We analyzed the monthly payment associated with owning a home in these areas. Our analysis showed that we can rent our units for ~$1,000 less then it would cost to own the average home in this market.

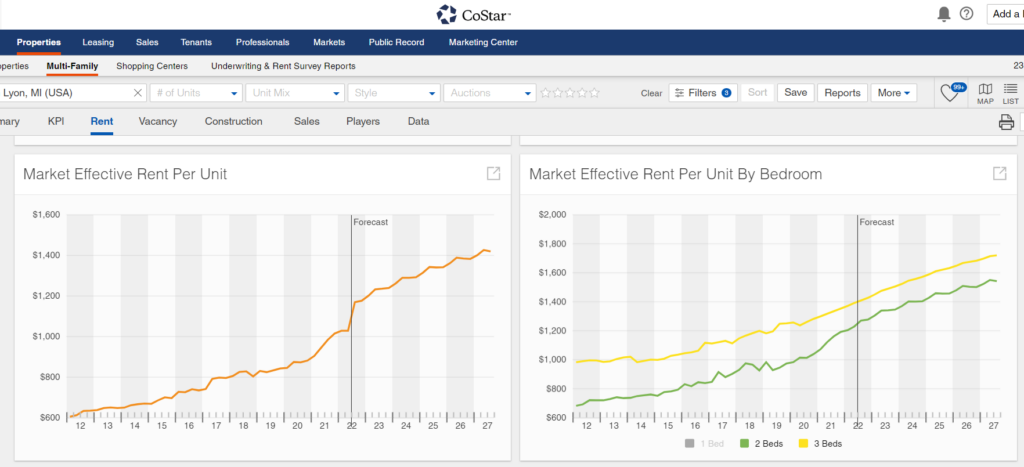

Given this position I see rental rates jumping another 10-20% over the next 5 years (Costar predicts ~37% increase over next 5 years) We obviously hope Costar is more accurate than us in this prediction, but that drastic of an increase over a short is a dangerous underwriting metric to plan for. The 14% increase we have seen nationwide over the last year certainly won’t continue but in markets where we can buy at such a discount to ownership, I’m certain rental prices will continue to rise.

Summary

Rental rates have decreased only once in the last 70 years. The primary time multifamily owners are forced to sell is if they need money to make up losses from another venture. Our properties are not cross collateralized, so for our investors this risk does not exist. As long as people still need a home, we feel good about our current portfolio and will continue to buy with conservative debt and well financed reserves in case there is a storm that needs to be weathered.

Major Market News

| Built to Rent Communities The demand for places to rent in 2021 and 2022 is enough to support the trending built to rent concept. An article by Manage Casa says, “a record 6,740 new built-to-rent houses were completed in 2021, and that 14,000 new houses for rent might be ready in 2022.” The article states that most of these communities are in the south and southwest. You can read the full article here https://managecasa.com/articles/build-to-rent/. |

| Tips and Tricks |

| Check out These Terms: Reserves- Reserves are funds held for future repairs, deferred maintenance, property taxes, debt payments, and any others. In simple terms, it’s a “rainy day fund” but may be used for a myriad of other items. We typically budget for $250 to $450 per unit per year to be held in our reserve account. This allows us to be prepared in the case of an unexpected major expense. For example, we had a ~$3,000 water main leak at our 24 unit in Fenton a couple weeks ago. If we were running too lean, this would have been a major expense and could set us back on our cash flow goals. While it’s not ideal by any means, we are happy to have a small war chest for situations like this. |