The Capital Stack

| What makes a profitable multifamily purchase? |

Is it a good deal?

We have found success in the multifamily space by checking that each property we purchase meets certain criteria. We like to target value add properties built in the 1970 or later with 20+ units. There are two types of value add. Physical value add and operational value add. Ideally, we can capitalize on both forms. We can add the highest amount of physical value to a property when all the units have not seen renovations in the last 7+ years. We look to spend between 5k to 25k per unit on interior renovations depending on the locations of the property. We look for properties where the renovations will lead to rent increases of at least $150 each month per unit. In some cases, we have had increases as high as $900 per month after renovations were completed.

Currently all properties owned by Sheffer Capital were purchased below replacement cost. Right now, we figure replacement cost to be around $150 to $250 per sq. The exact figure depends on the property’s location. By purchasing under replacement cost we protect ourselves from competing with new development in the area because we can charge a lower rent than our competition and still meet our return expectations.

This is not a “one size fits all” model. Every deal we purchase will likely not meet all the guidelines and there are acceptations to our guidelines. For example, the 8-unit property we just purchased in Royal Oak was built prior to 1970. However, after renovations we are anticipating a rent increase of ~$1,400 per month for each unit. The extra value provided by the large, anticipated rent increase vastly off sets the age of the property.

Inspections and Budgets

During the due diligence period we always complete a thorough inspection. The goal of this inspection is to ensure our renovation budget is accurate and to avoid any surprises after closing. In most cases there isn’t any reason to pull out of a deal because of finding in an inspection as long as the repairs meet the renovation budget. During the inspection of our property in Fenton, MI the inspector discovered the foundation needed $40k of repairs. It is important to have this information before closing so you can budget properly for renovations.

Is It A Good Location?

We own properties in Michigan, South Carolina, and Texas. We really like these states and would like to expand to more properties in each. However, not every location is a good fit, there are certain states/cities that have rent control laws. Properties in these areas are not a good fit for us. We like to target areas with a home value of $250,000 and a median household income of $60,000. Ideally, we purchase 45 mins from a major city. We try to purchase properties near large employers like hospitals. We do not want to buy in locations where a single employer or industry is responsible for much of the populations employment. If that employer/industry were to go under, we could be left with a significant number of vacant units as well as a building with diminished value.

Picture Williston, ND for example. This was a huge oil boom town in the late 2000’s-2014. The population grew 83% and it was one of the largest growing cities in the country. https://www.foxbusiness.com/politics/fracking-williston-north-dakota-oil-boom-population-growth

Then oil dropped, and everyone left. https://www.reuters.com/investigates/special-report/usa-northdakota-bust/

At the moment there are several properties in Williston that were built in 2010-2013 that are available for ~$66k per unit. If this product were in one of the markets we typically target, we would be all over it trying to buy it and prices would likely be 3x what they currently are.

We try to purchase C class properties in A locations. Below are photos of our Royal Oak property (Harvard Lofts). A perfect example of a C class property in a A location.

Royal Oak Median Household Income – $81,665

Royal Oak Median Home Value – $298,783

Major Market News

More on Multifamily in 2022

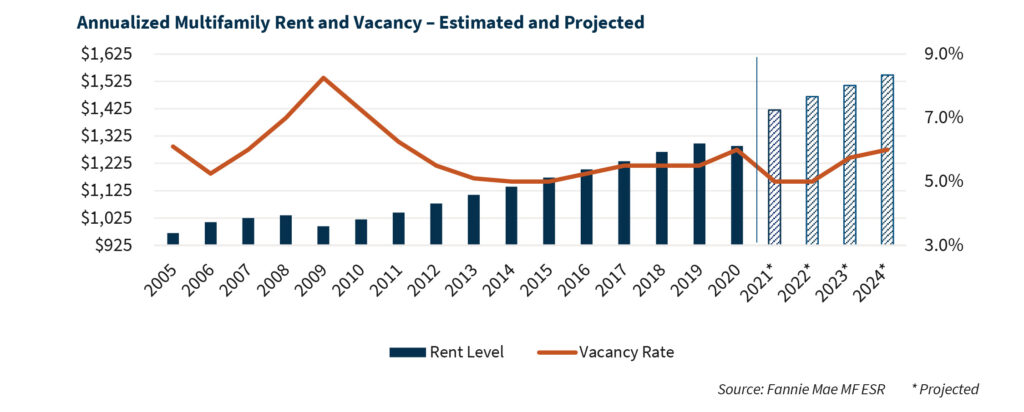

According to an article by Yardi the multifamily market is poised for a strong year in 2022. The article mentions that while the “record setting rents” experienced in 2021 are not expected to continue the demand in 2022 is anticipated to be ” robust”. The article also addresses multifamily investing and states “Investor activity is also expected to continue apace, as capital conditions look favorable”. You can check out the full article here >>https://www.prnewswire.com/news-releases/despite-anticipated-rent-slowdown-multifamily-poised-for-a-strong-2022-yardi-matrix-reports-301465947.html. It’s a exciting time to own and purchase multifamily real estate.

Tips & Tricks

Check out some popular real estate terms:

| Rent Control This is just what it sounds like. The government chooses what rent prices can be and how much a property owner can increase them by. This is very popular in states like New York and California. St. Paul just recently enacted rent control laws for the first time in the State of Minnesota. In St. Paul rent increases are restricted to 3%. This is a massive hit to landlords as inflation and costs have risen by more than double that figure. Physical Value Add Physical value add consists of several items. This includes interior renovations, fixing all deferred maintenance, and improving overall curb appeal. Outside of the benefits of less ongoing maintenance from repairs, we are often able to get a 30%+ annual return on costs of these improvements. For example, if a basic $5,000 interior renovation yields $150/month increase in rent. $150 X 12 (months) = $1800 $1800 / $5000 = 36% Operational Value Add Operational value add is something we have done a lot of. This is increasing the income to the property simply by operating better than the prior owner. Our 24 unit property in Fenton for example. There were 10 units vacant when we purchased this. These units had been vacant for nearly 3 years. It was clear the owner was not managing properly because we were able to renovate and lease these units in ~6 months after closing. “Below Replacement Cost” Replacement cost is the amount of money it would cost to replace the property where it sits today excluding land costs. Hard costs on apartments in suburban areas of Michigan are running $125-$185 per square foot. We recently purchased Hollyvillage Apartments in Holly, MI for $71 per square foot. This includes land costs. It’d be impossible to build a similar product in this location for our cost so we aren’t worried about new competitors coming in to build brand new and compete with us on pricing. |

Thank you for reading and your interest in Sheffer Capital. We look forward to having you follow along on the journey.

To receive this weekly newsletter in your inbox, subscribe here: https://sheffercapital.us5.list-manage.com/subscribe?u=5432a875f8870a0b9cfab4b97&id=dad13cf5e0