The Capital Stack

Taxes & Commercial Real Estate

Often, we encounter property owners who are hesitant to sell due to the significant tax burden they would face after parting ways with their property. While this may seem like one of those “champagne problems”, it is a genuine concern for many. Selling a property can result in a tax rate of over 35%, which can significantly diminish the net proceeds from a sale.

In the realm of commercial real estate, the tax implications of selling a property can be significantly more impactful than what you would encounter selling a residential property. This is due in part to the fact that most commercial properties often undergo significant depreciation, leading to a lower “cost basis” by the tax code compared to the purchase price. For instance, if owner A buys an apartment building for $5,000,000 and applies straight line depreciation over 27.5 years, the annual depreciation will amount to $181k. Over a period of 10 years, this would add up to ~$1.8m in total depreciation. When the property is eventually sold, there is a “recapture” process in which the owner must pay back the taxes saved, as a result of the depreciation.

Now suppose after owning the property for a decade, owner A receives an unsolicited offer from us to purchase the property for $7,000,000. Without considering depreciation, the profit they would earn on this sale is $2,000,000. Assuming a long-term capital gains tax rate of 20%, owner A would owe $400,000 in taxes. However, with depreciation recapture considered, the owners profit increases to ~$3.8m which they now need to pay income tax on. Landing in the 37% income tax bracket the tax payment amounts to ~$1.8m. This could discourage owner A from selling as their net profit decreases from $1,600,000 after taxes to ~$200k. The previous owner of the suburban 36 portfolio we acquired had concerns about the taxes he would owe upon the sale. As a result, he found our seller financing option attractive, which ultimately proved to be beneficial for all parties involved.

*Thanks to ChatGPT, exact math in “tips & tricks section”

Tax-Saving Tactics

Option 1- 1031 exchange.

A 1031 exchange is a tax-deferred strategy used by real estate investors to sell a property and reinvest the proceeds into a similar property without having to pay immediate capital gains taxes. The IRS allows you to roll proceeds from the sale of a property into a new property at or above the same value. Assuming the owner we mentioned before wants to do a 1031 exchange, after selling his property to us for $7,000,000, he would need to reinvest the entire amount or more into a like-kind property to avoid immediate capital gains taxes. Here’s where it gets good. The owner’s ultimate goal was to walk away from the sale without a large tax bill and with cash in his pocket. He can achieve this by purchasing a new property for $7,000,000 in cash and then taking out a conservative loan of, say, 50% from a bank. This gives him immediate access to $3,500,000 million in cash without incurring any taxes as these funds are considered loan proceeds. Of course, the caveat is you must find a property that meets the your purchase criteria within the 1031 timeframe of 45 days to identify, and 180 days to close.

In November 2021, we used our 1031 funds from the sale of the Ferndale 28 portfolio to purchase the Altitude Apartments, a 52-unit property in Royal Oak. With the proceeds from the sale of Ferndale 28 fully reinvested, we had more equity than necessary, allowing us to distribute just over $750,000 from the new entity. This was possible because we had fulfilled our 1031 obligations and had ample cash reserves to make the distribution.

Option 2- Stepped Up Basis

In estate planning, parents leaving properties for their children is a common scenario, and the IRS has a program called stepped up basis. Stepped up basis is a tax term that refers to the readjustment of the value of an appreciated asset for tax purposes when it is inherited. When an owner passes away, whoever inherits the property receives a stepped-up basis to market value. This means that if the heirs sell the asset, they will only owe taxes on any gains that occur after the date of inheritance, rather than on the gains that occurred during the lifetime of the original owner. This allows them to sell the property immediately without incurring any capital gains tax since the cost basis now becomes the market value of the property. Stepped Up Basis is one of the most tax-efficient ways of passing wealth from one generation to the next.

In the fall of 2021, a broker brough to our attention a 28 unit property in Wixom Michigan. We expressed interest and made an offer on the property, which had recently been inherited by the children of the previous owners. The heirs lacked the experience and desire to manage the property themselves. Given the stepped-up basis, they could have sold it to us without incurring large capital gains tax, based on their family’s actual cost and received the full proceeds. However, not all of the siblings were on the same page, and some wanted to hold onto the property. In situations where there is not a designated decision-maker this scenario is not uncommon. Unfortunately, in this instance the timing was not in our favor.

In some cases, property owners may not be aware of stepped-up basis or 1031 exchange. In the case of inheritance, the property’s cost basis resets to the market value at the time of the owner’s death, allowing the heirs to sell the property without incurring capital gains tax. On the other hand, the 1031 exchange is a productive strategy to defer taxes, in addition a cash-out refinance after the exchange can provide tax-free access to cash, which is often the primary reason for selling a property.

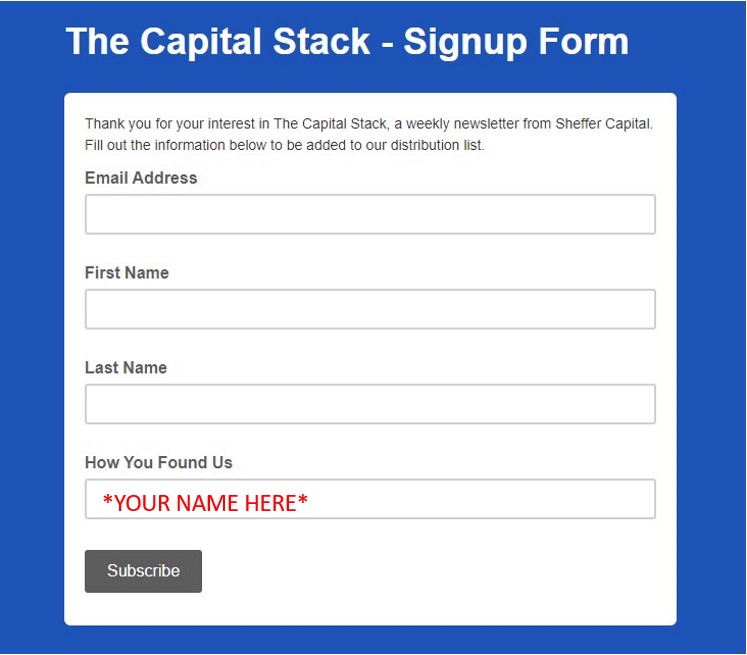

Newsletter Growth: Road to 5,000

Current Count: 2,429

-8 in the past week!

We are looking to grow our newsletter subscriber list. Currently we have 2,429 subscribers and the goal is 5,000. Since last week’s newsletter we have lost 8 subscribers. First negative ever. Positive affirmations telling myself it’s keeping the list to a higher quality of readers, so I appreciate you being here. Also, looks like I need to promote more online and keep this number rising.

Major Market News

Stepped Up Basis & 1031 Exchange

Both stepped-up basis and 1031 exchange are tax-saving tactics that property owners can use to defer or avoid paying capital gains taxes when selling their properties. As buyers seeking to acquire properties from owners who can benefit from these strategies, it is crucial that we are knowledgeable about the details of both. Check out the articles below for more information on Stepped-up Basis and 1031 Exchange.

Stepped Up Basis-https://www.investopedia.com/terms/s/stepupinbasis.asp#:~:text=Step%2Dup%20in%20basis%2C%20or,the%20asset%20is%20sold%20later.

1031 Exchange-

https://www.investopedia.com/financial-edge/0110/10-things-to-know-about-1031-exchanges.aspx

Tips and Tricks

Terms:

Straight line method– For residential properties (Apartments or homes) the IRS allows you to write off the total value of the building over a 27.5-year period. So, each year you can take a depreciation loss of 1/27.5.

Depreciation and Bonus Depreciation– To write off the value of a residential property over a 27.5-year period, the IRS allows for an annual depreciation loss of 1/27.5. However, with a cost segregation study, the property can be broken down into individual components, such as electrical wiring, carpet, lights, outlets, and more, each with its own taxable life of either 5, 15, or 27.5 years, and depreciation can be based on those individual amounts. In addition to this, Bonus Depreciation is allowed by the IRS. For any part of the property classified in the 5 or 15-year life category, an 80% depreciation can be taken in the first year. This program is being phased out, so the amount will drop by 20% in the coming years, having been 100% up until this year.

Depreciation recapture:

Purchase price: $5,000,000

Depreciation per year: $5,000,000 / 27.5 = $181,818.18

Depreciation for 10 years: $181,818.18 x 10 = $1,818,181.81

Adjusted cost basis: $5,000,000 – $1,818,181.81 = $3,181,818.19

Sale price: $7,000,000

Adjusted cost basis: $3,181,818.19

Realized gain: $7,000,000 – $3,181,818.19 = $3,818,181.81

The unrecaptured section 1250 gain can be calculated as:

Depreciation for 10 years: $181,818.18 x 10 = $1,818,181.81

Unrecaptured section 1250 gain: $1,818,181.81

The capital gain on the property is:

Realized gain: $3,818,181.81

Unrecaptured section 1250 gain: $1,818,181.81

Capital gain: $2,000,000

To calculate the total tax payment based on a 20% capital gain tax rate and 37% income tax rate, we need to calculate the capital gains tax and the income tax separately and then add them together.

Capital gains tax = Capital gain x Capital gain tax rate

Income tax = (Capital gain + Income) x Income tax rate

Here’s how we can calculate the total tax payment:

Capital gains tax = $2,000,000 x 0.20 = $400,000

Income tax = ($3,818,181.81 + $0) x 0.37 = $1,412,727.27

Total tax payment = Capital gains tax + Income tax

Total tax payment = $400,000 + $1,412,727.27

Total tax payment = $1,812,727.27

Therefore, the total tax payment based on a 20% capital gain tax rate and 37% income tax rate for a $7,000,000 sale price in year 10 would be $1,812,727.27.