The Capital Stack

Our Investment Structure

Recently, I have received multiple inquiries from prospective investors regarding our investment structure, including the specific percentage and sample numbers of the returns on investment for our future acquisitions. In this article, we will explore the details of our investment structure and provide a clear picture of what an investment in one of our upcoming acquisitions could look like.

First, Let’s Start with Terminology

Preferred Return: also known as “pref”, is a common term used in the real estate industry to refer to a rate of return that is paid to investors before any profits are distributed to the sponsors or general partners. In our past deals, we have offered a preferred return of 7-8%, but moving forward, we have decided to standardize it to 8% across all our deals. While we used to adjust this rate slightly depending on the specific deal, we are now in consolidation mode and believe that providing consistent terms across all our deals will help investors understand what they can expect from their investment with us.

Promote: In the real estate industry, “promote” refers to the percentage of the distributions that are paid to the General Partner (GP) or Sponsor after the preferred return (pref) has been paid to the investors. In our previous deals, this percentage has varied between 20% to 50%, but moving forward, we have decided to set it at a standard rate of 30%. This will ensure that our GP compensation is consistent across all our deals, providing transparency and predictability for our investors.

Internal Rate of Return (IRR): is a financial metric used to evaluate the potential profitability of an investment over a specific period. The higher the IRR, the more profitable the investment is considered to be. It is a widely used performance metric in the real estate industry to evaluate the viability of a real estate investment opportunity.

Multiple on Invested Capital (MOIC): A financial metric used to measure the total return on an investment relative to the initial capital invested. It is calculated by dividing the total cash distributions received from the investment (including both principal and profits) by the initial investment amount. The MOIC provides a quick and simple way to assess the profitability of an investment and is commonly used in the private equity and real estate industries to evaluate the performance of investment opportunities.

To summarize, in all our future deals, we will offer a standardized preferred return (pref) of 8%, and a General Partner (GP) promote of 30%. This means investors receive the first 8% of returns, and any subsequent cash flows are split 70/30 in favor of the investor. This clear and consistent investment structure provides transparency and predictability for our investors and helps them make informed investment decisions.

The Math Behind It

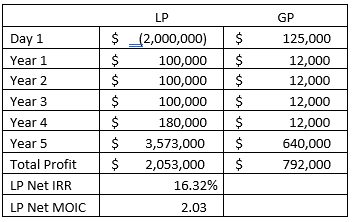

Assuming we purchase a property for $5 million, we would aim to raise approximately $2 million in equity. The first three years of the investment are focused on executing our value-add business plan, which would typically generate an annual return of 3-5%. By the end of year three, we should have stabilized the property, and years four and five should yield an annual return of 9%. If we were to sell the property for $7 million at the end of year five, the investment would achieve a 16.32% Internal Rate of Return (IRR) and a 2.03 Multiple on Invested Capital (MOIC), which meets our minimum target goals. This hypothetical scenario illustrates how our investment strategy can generate attractive returns for our investors through our value-add approach and our disciplined investment process.

After reviewing the table above, you will see the investment did not hit the preferred return (pref) of 8% during the first three years. However, the returns exceeded the pref in years four and five. As a result, the investors are still owed the unpaid pref amount of $140,000 from the sale proceeds. Once the accrued pref is paid, the investors receive their initial investment of $2 million, followed by the GP receiving a 1% disposition fee of $70,000. The remaining amount of $1,790,000 is then split 70/30 in favor of the Limited Partner (LP) and the General Partner (GP), respectively. This results in the LP receiving $1,253,000 and the GP receiving $537,000. This example highlights how the investment structure with a pref and promote split ensures that the investors receive their preferred return first, and then the profits are split between the LP and GP based on the agreed-upon terms. In this example, the GP (Sheffer Capital) would not receive any payment until the property is sold, aside from the acquisition and asset management fee.

Let’s Talk About Fees

Acquisition Fee: The acquisition fee, which is typically paid to the GP for sourcing and closing the investment, has ranged from 2% to 4% in our past deals. However, going forward, this fee will be set at 2.5%. The previous variation in the fee was based on whether we sourced the debt ourselves or used a debt broker to secure the loan. If we engaged a debt broker, they would receive a 1% fee, which we would not charge in addition to our acquisition fee. But if we sourced the debt through personal relationships, we would collect the additional 1% as part of the acquisition fee.

Asset Management Fee: The asset management fee is a fee paid to the GP for their time and effort spent managing the property and executing the business plan. This fee is set at 2% of the property’s gross income. For example, if a 50-unit property has a monthly rent of $1,000 per unit, its gross income would be $600,000 per year. The GP would then receive a fee of 2% of this amount, which is $12,000.

Disposition Fee: The disposition fee is a fee paid to the GP for their efforts in preparing the property for sale and closing the transaction. Typically, this fee is set at 1% of the sale price. Additionally, this fee would also be charged on a refinance, where it would be set at 1% of the loan amount.

So, as you can see in the table above, on a successful deal, we would make a total of $792,000. Investors would make $2,053,000. The majority of our income and profits, is derived from the promote, which is essentially a bonus as we need to make sure the investors are returned over 8%, before we make anything meaningful.

There are Two Sides to Every Coin

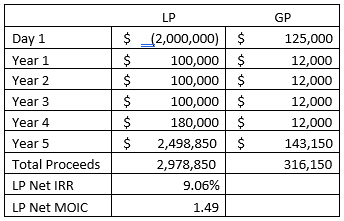

Suppose the investment doesn’t go as expected, resulting in a 9.06% IRR and 1.49 MOIC. I would consider this to be a poor deal. See example below. If we purchased the property for $5 million and sold it for $5.45 million in year 5, with the same annual cash flow for simplicity. Although it still works out okay for everyone, it falls significantly below our expected returns.

For those who may have concerns about the possibility of a property not appreciating in value, we have a strategy in place to mitigate that risk. We buy properties with debt that has a term of at least 5 years. This gives us a timeframe to refinance the property and hold onto it for a longer period, until it makes sense to sell. The value of properties is influenced by interest rates, as investors are always seeking higher yields. Therefore, it is most advantageous for us to sell when interest rates are at their lowest. Our primary goal is to avoid being forced to sell a property. We invest in multifamily which provides essential housing to middle class residents. This, coupled with the structure of our deals, makes us confident that we won’t be forced to sell our properties unless there is an unforeseen catastrophic event. Our main goal is to avoid being a forced seller, and we believe that the properties we target and the deals we structure will help us achieve that goal.

Newsletter Growth: Road to 5,000

Current Count: 2,440

-11 in the past week!

We are looking to grow our newsletter subscriber list. Currently we have 2,439 subscribers and the goal is 5,000. Since last week’s newsletter we have gained 11 new subscribers.

Major Market News

New York’s Flat Iron Building

The Flatiron Building in New York City has been sold to a mysterious buyer for $190 million. The buyer was a unknown to the real estate community, Jacob Garlick. The seller was Sorgente Group, GFP Real Estate, & ABS Real Estate Partners. The ownership group was forced to sell the building because the partners could not agree on the building’s renovation plans. The Flatiron Building is a historic landmark and one of New York City’s most recognizable buildings.

What’s also interesting, Jacob Garlick failed to fund his $19m deposit that was due on Friday and has said he’s not going to move forward with his option to purchase. The 2nd place bidder, GFP Real Estate, has also declined to purchase at their last bid price of $189.5m, meaning this building will likely go back to auction, unless it ends up trading hands in the back of a courtroom sometime in the next few weeks.

Link To Original Article: https://therealdeal.com/new-york/2023/03/24/meet-the-mysterious-buyer-of-the-flatiron-building/

Link to Article RE: Deposit: https://therealdeal.com/new-york/2023/03/24/garlick-fails-to-cough-up-deposit-for-flatiron-building/

Tips and Tricks

Tips- Offer Attractive Investment Terms to Investors

As a sub-institutional firm, we place a high value on our investors and strive to offer an investment structure that is favorable to them compared with what the public markets will provide. We understand that attracting investors is crucial to scaling our business, and we want to demonstrate our appreciation by offering & achieving, generous returns with a low level of risk.