The Capital Stack

Projections

Since the beginning of the year, we have been occupied with the task of filling our “pipeline” with potential properties to acquire. This involves spending numerous hours studying an Excel spreadsheet, analyzing data, and forecasting potential revenue and expenses. Although we’re excited to disclose information about the properties we intend to acquire it’s still a bit too soon. Instead, let’s discuss our process for projecting income and expenses.

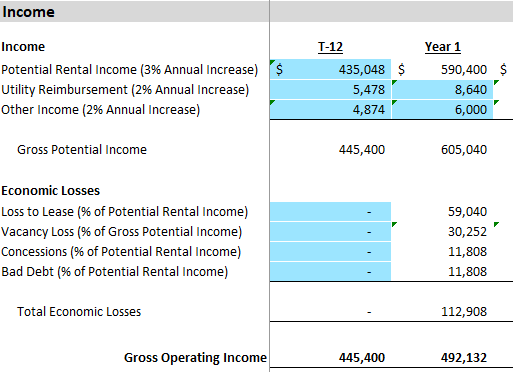

Forecasting the Year 1 performance of a value-add multifamily property can be a daunting task, particularly for inexperienced owners. In order to accurately evaluate a potential investment opportunity, it is necessary to assign numerical values to factors such as vacancy, loss to lease, bad debt, expenses, and other variables. We rely on our experience to estimate these values and project the expected performance of the property in its first year.

Here’s Our Approach to Estimating Year 1 Income:

First, we must determine the time required for a complete unit turn. For the sake of simplicity, let’s assume that each unit requires one month to turn. In the case of a 50-unit property, we can expect to renovate all the units within a span of two years, implying 25 units in the first year and 25 units in the second year.

The 25 units that are expected to be vacant and turned in Year 1 correspond to a total of 25 months of vacancy. Assuming a 50-unit property with a potential occupancy period of 600 months (50 x 12 = 600), the 25 months of vacancy translates to a 4.2% vacancy rate (25 / 600 = 0.042). Rounded to the nearest whole number, this equates to a 5% increase over the baseline 5% vacancy that is expected without the planned units turns. Therefore, we estimate a total of 10% physical vacancy for the property.

The next factor to consider is the loss to lease. In a scenario where the current rent is $800, but the market rent is $1,100, there is a loss of $300 per unit per month. Assuming a turnover rate of two units per month, with three units in the twelfth month, we can expect to miss out on $140,400 in annual income. This equates to 21.3% of the gross potential rent. Rounding this up, we estimate an 22% loss to lease factor for Year 1.

Finally, we factor in potential bad debt and concessions. We typically plan for 3% in Year 1.

Combining all these factors, our estimated Year 1 economic vacancy factor would be 35%, including 10% for physical vacancy, 22% for loss to lease, and 3% for bad debt and concessions.

With a gross potential rent of $1,100 per unit and a total of 50 units, we can compute the anticipated gross rental income for Year 1, which would amount to $660,000. However, considering the 35% vacancy rate that we estimated earlier, the projected gross rental income for Year 1 would be $429,000.

Now that we have the projected income for Year 1, we can then incorporate the additional income generated from the remaining units to be turned in Year 2. By Year 3, the property is considered “stabilized,” which means that it is fully turned and operating as anticipated.

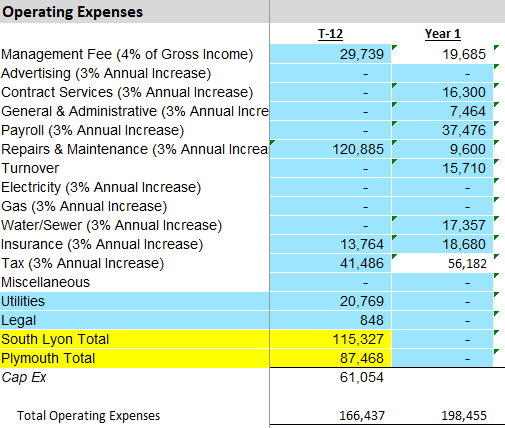

Here’s Our Approach to Estimating Year 1 Expenses

The knowledge and experience we gained from owning multifamily is key to successfully projecting expenses on new acquisitions. Since many of the costs associated with multifamily properties are fixed, it is relatively easier to forecast expenses than it is to project income.

Management fee- 4% of gross revenue.

Contract services – A few examples of the line-item title “contract services” are lawn and snow care. Depending on the size of the property we are typically looking at $100-$450 per lawn cut and per snowplow. This will typically shake out to $200-$400 per unit annually.

General expenses- Cover items such as fees for property management software, postage (if applicable), and any bank charges incurred.

Payroll – Payroll expenses encompass the labor and time spent by leasing agents, maintenance staff, and other employees. While the management company may charge a 4% fee for their services, the actual costs associated with their employees’ time are also paid by the property as a separate line item. It’s worth noting that some people may view management fees as all-inclusive, but in reality, the 4% fee is typically a profit fee for the management company. In most cases, the costs associated with payroll expenses will fall under the categories of general expenses and payroll.

Repairs & Maintenance – Under the category of repairs and maintenance, we typically plan for an annual expense of $350 to $450 per unit, depending on the scope of the unit turns. This can include major repairs such as a new hot water heater, which may cost around $1,200 for one unit, while another unit may require no repairs at all. When averaged out, typically the blended average cost is $350 to $450 per unit per year.

Utilities – Utility expenses are estimated by making an informed guess based on historical data provided by the seller. To ensure accuracy, we cross-reference this data with other similar properties that we own to check for any irregularities.

Taxes- Taxes are a fixed expense for commercial properties. The calculation of taxes for such properties in Michigan follows a specific method, which has been explained in a thread that I wrote on Twitter. You can find the thread here: https://twitter.com/ToryJSheffer/status/1628825095631151110?s=20

Insurance – Insurance is another fixed expense for which we have a good estimate of around $500 per unit per year in Michigan. However, we always obtain a quote from our insurance agent during the due diligence period to confirm the final amount.

Once we have calculated the annual net operating income (NOI), we allocate $250 per unit per year to be set aside for long-term reserves, as well as to cover our mortgage payments. Any remaining cash flow is distributed to investors on a quarterly basis.

Newsletter Growth: Road to 5,000

Current Count: 2,437

+19 in the past week!

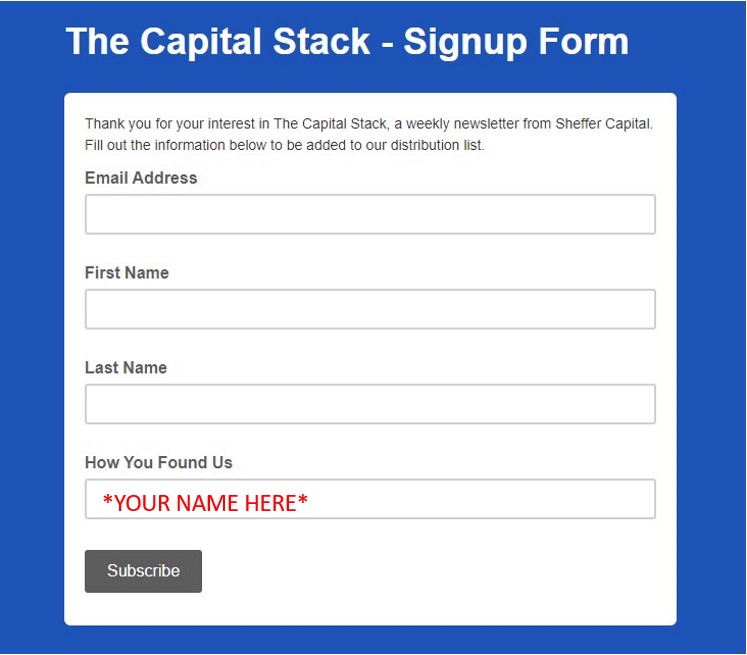

We are looking to grow our newsletter subscriber list. Currently we have 2,437 subscribers and the goal is 5,000. Since last week’s newsletter we have added 19 new subscribers. Let’s keep it going! If everyone gets 3 people to sign up, we beat the goal and will have something new to reach for. If you can get 3 people to sign up, I am happy to consult or answer any questions for 30 minutes on whatever you may be working on, or interested in. If you hate the idea of talking to me for 30 minutes but enjoy the newsletter, then just share it out of the kindness of your heart! Either way, the sharing is greatly appreciated!

*Have the new subscribers put your name or email in the “How You Found Us” section. *

* We have reached out via email to set up phone consults with all the subscribers whose names have been mentioned in the “How You Found Us” section. If we happened to miss your name, please send us an email and we will get you added to the schedule right away. *

Major Market News

Northville Downs proposes move to Plymouth Township

The Northville Downs racetrack, a historic establishment located in Northville, MI, is planning to move just 4.5 miles away from our 16-unit property in Plymouth, MI. According to a local news article, Plymouth Township is looking forward to this development, and a township supervisor has been quoted as saying “the plan for the new venue must include recreation and entertainment opportunities, such as community events, Fourth of July fireworks, and outdoor concerts.”

Link below to full article:

https://www.clickondetroit.com/news/local/2023/01/21/northville-downs-proposes-new-racing-facility-in-plymouth-township/#:~:text=PLYMOUTH%20TOWNSHIP%2C%20Mich.,former%20Detroit%20House%20of%20Corrections.

Tips and Tricks

Terms:

Bad Debt– Bad debt is a term used to describe unpaid debts, typically resulting from an eviction. It refers to a situation where a tenant owes a significant amount of money, but despite eviction and collection efforts, the debt remains outstanding and is unlikely to be recovered.

Loss To Lease– The term “loss to lease” is used to describe the difference between the actual rent being paid by a tenant and the current market rent for the same unit. For example, if a tenant is paying $800 for a unit when the current market rent is $1,100, the “loss to lease” would be $300 per month. This means that the property is not generating as much revenue as it could be if the unit were rented at market rate.