The Capital Stack

How we are looking to buy & finance quality deals today

We are currently looking to buy properties through seller financing or assumable mortgages. Because of the recent spike in interest rates, we have been forced to find alternatives to traditional financing. Since this spike, we have found some difficulty getting deals to pencil at prices sellers are willing to accept. We believe there is a vast disconnect between buyers and sellers. Sellers are expecting and hoping to sell their properties for the “top market pricing” we experienced last year when interest rates where much lower, between 3% to 4%. Because rates increased so quickly many sellers have yet to realize that buyers can no longer justify paying “top dollar”. Despite the increase in interest rates, we remain optimistic and believe that many opportunities exist to purchase quality properties at a price that works for us and the seller.

The numbers behind the “disconnect”:

Conventional debt. 6-7% currently. A year ago, debt was 3-4%. For this example, let’s assume a $1,000,000 loan interest only.

- Last year at 4% annual debt payments would be $40,000

- This year at 6.5% annual debt payments would be $65,000

- Banks require 1.25 DSCR so net income must be 1.25:1 with debt.

- Last year NOI required would be $50,000

- This year NOI required would be $81,250

NOI increase of 62.5% is required for those deals to pencil at the same purchase price. This is rarely the case therefore the “disconnect” between buyers and sellers we explained above is created.

Option 1: Seller Financing

We bought a portfolio (Suburban 36) in July with a 4% fixed interest rate using seller financing. When conventional debt is not competitive seller financing is a great option. Sellers can secure the highest sale price and push the full payoff of their loan down the road. This also helps them defer capital gains taxes on the sale of their property as well. In today’s market including an option for seller financing when submitting an offer could prove very beneficial. Many sellers simply haven’t considered this option and its possible a seller finance deal is a win for the seller and a win for the buyer. This was the case when we purchased the Suburban 36 portfolio. Photo of a newly renovated unit at suburban 36 below.

Option 2: Assumable Loans

Some commercial deals have terms that allow a new buyer to take over the payments of the existing loan. Let’s say someone bought a property for $1,000,000 last year with a loan for 80% and a 4% fixed rate. Now it’s worth more and we are willing to pay $1,200,000 for the property. We can take over that loan for $800,000 keep the 4% fixed rate and come up with $400,000 for the down payment to close.

- Interest Only (IO) debt payments at 4% on $800,000 = $32,000

- Compared with IO debt payments at 6.5% on $800,000 = $52,000

- Debt 6.5% on 80% LTV 960k = 62,400

- Assume NOI for this sample= 80,000

- COC Assumable loan 4% = 12%

- COC new debt $800k 6.5% = 7%

- COC new debt 80% LTV ($960k loan 6.5%) = 7.3%

As you can see the annual cash on cash return is significantly better than getting new debt even though we’re required to have more money for the down payment ($400k vs $240k). We have offers out on a few properties that have an assumable loan but haven’t bought one yet. The biggest challenge is finding a property that meets our buying criteria and happens to have a loan that is assumable. Still a great option, just takes some digging.

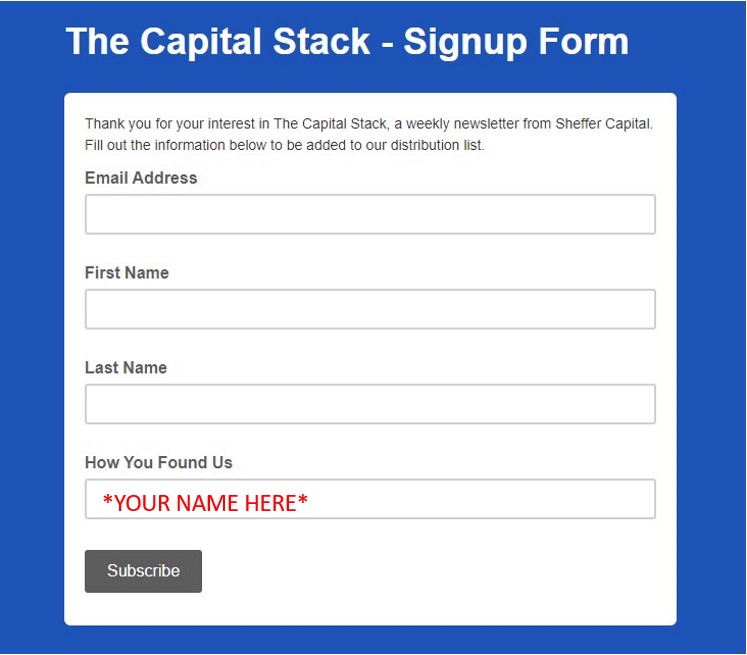

Newsletter Growth: Road to 5,000

Current Count 1,844

We are looking to grow our newsletter subscriber list. Currently we have about 1850 subscribers and the goal is 5000. If everyone gets 3 people to sign up we beat the goal and will have something new to reach for. If you can get 3 people to sign up, I am happy to consult or answer any questions for 30 minutes on whatever you may be working on, or interested in. If you hate the idea of talking to me for 30 minutes but enjoy the newsletter, then just share it out of the kindness of your heart! Either way, the sharing is greatly appreciated!

*Have the new subscribers put your name or email in the “How You Found Us” section.*

Major Market News

“Cheap Debt”

There’s an interesting article by the RealDeal that confirms our opinion on assumable mortgages. The article talks about the rising popularity of assumable mortgages and quotes “Assumable mortgages are now one of the hottest commodities in a tough sales market, giving buyers and sellers more flexibility as financing costs soar.” The article explains that assumable mortgages could allow sellers to achieve a higher sale price as they don’t have to offset the cost of the buyers financing. Assumable mortgages and seller financing are great ways to purchase properties at a time when rates are not good.

Check out the full article here: https://therealdeal.com/2022/11/18/how-to-sell-a-building-today-package-it-with-cheap-debt/

Tips and Tricks

Terms

Getting a deal to pencil: Simply means our underwriting projects we will hit the target returns using a price we have negotiated with the seller and they are willing to accept