The Capital Stack

Having an edge is a huge factor in multifamily investing.

Here’s one of ours. Sub 2-minute read we would love your feedback.

Property Evaluation

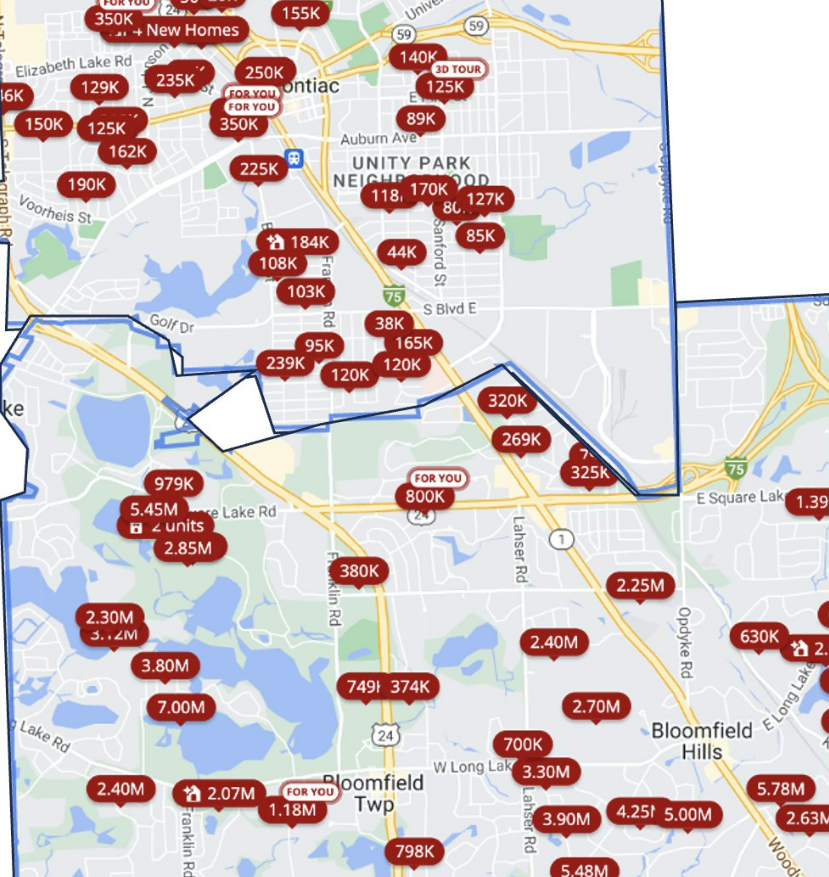

If you’ve been keeping up, you may know that our main criteria for identifying potential locations to acquire more apartments are in income thresholds of $60,000 or higher and where home values are $250,000 or more. We focus specifically on zip codes and our hyper local market knowledge. You can read a complete article on our buying criteria here.

Evaluating comparable properties within a 1, 3, or 5-mile radius of a potential acquisition, or going by county is incredibly skewed, yet all the major data sources focus on it.

This puts those outside of the market at a disadvantage because their data sources will be too “zoomed out”.

Here’s an Example in our Local Market

Bloomfield Hills and Pontiac border each other in Oakland County, MI.

Bloomfield Hills

- 48302 zip code

- Average Home Value $751,000

- Median Income $167,500

Pontiac

- 48341 zip code

- Average Home Value $145,000

- Median Income $40,631

Now, they’re both in the same county, Oakland County.

Oakland County

- Average Home Value $350,000

- Median Income $40,638

A deal in Bloomfield Hills should sell for ~2x the premium of the average in the county and a ~3x+ the premium to Pontiac.

We are willing to pay $130,000 per unit, and possibly more, for almost any deal in Bloomfield Hills. We have no interest in purchasing anything in Pontiac, even at $40,000 per unit. We are a competitive bidder in almost every other market in Oakland County except for Pontiac and a few specific zip codes.

Pontiac deals will cite Bloomfield Hills, Auburn Hills, Troy, and other solid surrounding markets as “comps” when these markets are far from comparable.

This isn’t an isolated case; variations of this situation exist in every market. Our primary edge lies in being a local operator and buying deals within an hour of where we live.

The Streets

Understanding the streets. Take, for instance, the 48220 zip code, Ferndale, which is great. However, areas north of 9 mile are considered superior by those who know it. There’s a property located in 48220, bordering the famous 8 mile, that has been on the market for over a year. The challenge lies in the sellers expectation of pricing comparable to the “north of 9 mile” standard, which has proven unattainable, especially in today’s market.

In Closing

Our strength in multifamily investing comes from a sharp focus on local details and a deep understanding of the market. By honing in on specific streets and areas, we refine our investment strategy for better outcomes. Join our Investor Portal or schedule a call to chat with us about future opportunities.

Major Market News

Detroit’s 8 Mile Road

According to an article by 8-mile Boulevard Association 8-Mile Road in Detroit has gained significant fame and was even featured in the 2002 film “8 Mile” starring Eminem. This road has become a figurative divider between the city of Detroit and its suburban areas, a perception that has influenced public policy and private investment, contributing to socioeconomic differences and tension in the region. Despite its reputation as a dividing line, 8-Mile Road holds a historical significance as Baseline Road, playing an important role in mapping the Northwest Territories.

Source: 8-mile Boulevard Association. (2024, Feb 1st) Eight Mile Road: Michigan’s Baseline for Change. https://www.eightmile.org/eight_mile

Tips and Tricks

Terms-

“Comps”: “Comps” is a shorthand term for “comparables” or “comparable properties.” Comparable properties are those that are similar to a subject property in terms of various factors such as size, location, amenities, and condition. Real estate professionals, including appraisers, investors, and real estate agents, use comps to assess the value of a specific property.